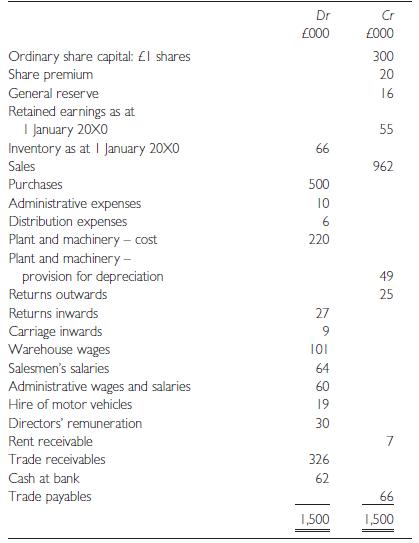

Basalt plc is a wholesaler. The following is its trial balance as at 31 December 20X0. The

Question:

Basalt plc is a wholesaler. The following is its trial balance as at 31 December 20X0.

The following additional information is supplied:

(i) Depreciate plant and machiner y 20% on straight-line basis.

(ii) Inventor y at 31 December 20X0 is £90,000.

(iii) Accrue auditors’ remuneration £2,000.

(iv) Income tax for the year will be £58,000 payable October 20X1.

(v) It is estimated that 7/11 of the plant and machiner y is used in connection with distribution, with the remainder for administration. The motor vehicle costs should be assigned to distribution.

Required:

(a) Prepare an income statement and balance sheet in a form that complies with IAS 1. No notes to the accounts are required.

(b) Briefly explain what you would expect to find in the following sections of a UK company annual report:

(i) Directors’ report. (ii) Chairman’s report. (iii) Auditors’ report.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273712312

12th Edition

Authors: Barry Elliott, Jamie Elliott