Cairnhall Ltd had the following balances at 31 March 2012. The following information is available. (i) The

Question:

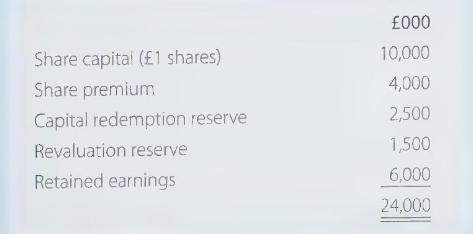

Cairnhall Ltd had the following balances at 31 March 2012.

The following information is available.

(i) The profit after tax of Cairnhall Ltd for the year to 31 March 2013 was \(£ 1,100,000\). "

(ii) Dividends of \(£ 400,000\) and \(£ 300,000\) were paid on 1 October 2012 and 18 March 2013, respectively.

(iii) Cairnhall Ltd revalues non-current assets but does not make transfer from revaluation reserve to retained earnings in respect of excess depreciation. At 31 March 2012, depreciation on revalued assets was \(£ 120,000\) higher than the depreciation on the historical cost amount. In the year to 31 March 2013, depreciation on the revalued amount was \(£ 50,000\), and depreciation would have been \(£ 30,000\) based on historic cost.

(iv) A revaluation at 31 March 2013 gave rise to a revaluation loss of \(£ 350,000\). This was debited to the revaluation reserve as it related to assets that had previously been revalued upwards.

(1) In March 2013, Cairnhall sold engineering equipment to a customer in China. In return, Cairnhall received electrical goods that it would use in its east European factories. As the value of the electrical goods exceeded the cost of the engineering equipment, \(£ 50,000\) profit was included in Cairnhall's profits for the year.

(vi) On 30 June 2012, Cairnhall made a 1-for-10 bonus issue out of retained earnings.

(vii) At 31 March 2012 all the profits in retained earnings were distributable.

\section*{Required}

(a) Calculate the distributable profits of Cairnhall Ltd as at 31 March 2013.

(b) Prepare an extract of the capital and reserves section of the statement of financial position of Cairnhall Ltd as at 31 March 2013.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780077138363

2nd Edition

Authors: John McKeith, Bill Collins