Harry is about to start negotiations to purchase a controlling interest in NX, an unquoted limited liabil-

Question:

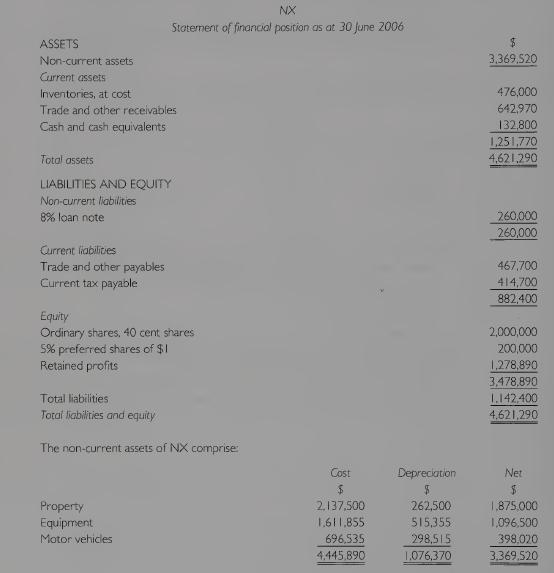

Harry is about to start negotiations to purchase a controlling interest in NX, an unquoted limited liabil-

ity company. The following is the statement of financial position of NX the company’s most recent financial year.

NX has grown rapidly since its formation in 2000 by Albert Bell and Candy Dale who are currently directors of the company and who each own half of the company's issued share capital. The company was formed to exploit knowledge developed by Albert Bell. This knowledge is protected by a number of patents and trademarks owned by the company. Candy Dale’s expertise was in marketing and she was largely responsible for developing the company’s customer base. Figures for turnover and profit after tax taken from the statements of comprehensive income of the company for the past three years are:

NX's property has recently been valued at $3,000,000 and it is estimated that the equipment and motor vehicles could be sold for a total of $ 1,568,426. The net realisable values of inventory and receivables are estimated at $400,000 and $580,000 respectively. It is estimated that the costs of selling off the company’s assets would be $ 101,000.

The 8% loan note is repayable at a premium of 30% on 3 I December 2006 and is secured on the company's property. It is anticipated that it will be possible to repay the loan note by issuing a new loan note bearing interest at I 1% repayable in 2012.

As directors of the company, Albert Bell and Candy Dale receive annual remuneration of $99,000 and £74,000 respectively. Both would cease their relationship with NX because they wish to set up another company together. Harry would appoint a general manager at an annual salary of $ 120,000 to replace Albert Bell and Candy Dale.

Investors in quoted companies similar to NX are currently earning a dividend yield of 6% and the average PE ratio for the sector is currently I I. NX has been paying a dividend of 7% on its common stock for the past two years.

Ownership of the issued common stock and preferred shares is shared equally between Albert Bell and Candy Dale.

Harry wishes to purchase a controlling interest in NX.

Required

(a) On the basis of the information given, prepare calculations of the values of a preferred share and an ordinary share in NX on each of the following bases:

(i) net realisable values;

(ii) future maintainable earnings.

(b) Advise Harry on other factors which he should be considering in calculating the total amount he may have to pay to acquire a controlling interest in NX.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273778172

16th Edition

Authors: Mr Barry Elliott, Jamie Elliott