Here is an extract from the Reckitt Benckiser 2007 Annual Report: The accounting policy states: An acquired

Question:

Here is an extract from the Reckitt Benckiser 2007 Annual Report:

The accounting policy states:

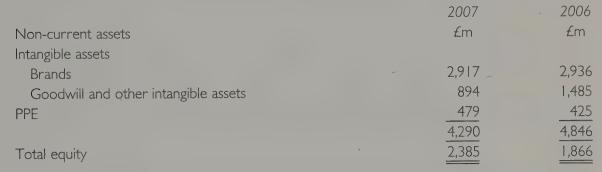

An acquired brand is only recognised on the balance sheet as an intangible asset where It Is supported by a registered trademark, is established in the market place, brand earnings are separately identifiable, the brand could be sold separately from the rest of the business and where the brand achieves earnings in excess of those achieved by unbranded products. The value of an acquired brand is determined by allocating the purchase consideration of an acquired business between the underlying fair values of the tangible assets, goodwill and brands acquired.

Brands are not generally amortised, as it is considered that their useful economic lives are not limited.... Their carrying values are reviewed annually by the directors to determine whether there has been any permanent impairment in value and any such reductions in their values are taken to the profit and loss account.

Discuss the suggestion that nothing has been achieved by separating the excess of the payment between goodwill and brands if both are treated in the same way, ie. reported at cost and reviewed for possible impairment.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273760887

15th Edition

Authors: Barry Elliott, Jamie Elliott