Oxlag plc, a manufacturer of pharmaceutical products, has the following research and development projects on hand at

Question:

Oxlag plc, a manufacturer of pharmaceutical products, has the following research and development projects on hand at 31 January 20X2:

(A) A general sur vey into the long-term effects of its sleeping pill Chalcedon upon human resistance to infections. At the year-end the research is still at a basic stage and no worthwhile results with any par ticular applications have been obtained.

(B) A development for Meebach NV in which the company will produce market research data relating to Meebach’s range of drugs.

(C) An enhancement of an existing drug, Euboia, which will enable additional uses to be made of the drug and which will consequently boost sales. This project was completed successfully on 30 April 20X2, with the expectation that all future sales of the enhanced drug would greatly exceed the costs of the new development.

(D) A scientific enquir y with the aim of identifying new strains of antibiotics for future use. Several possible substances have been identified, but research is not sufficiently advanced to permit patents and copyrights to be obtained at the present time.

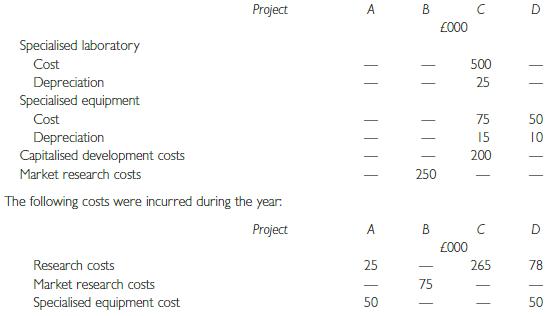

The following costs have been brought for ward at 1 February 20X1:

Depreciation on specialised laboratories and special equipment is provided by the straight-line method and the assets have an estimated useful life of 25 and five years respectively. A full year’s depreciation is provided on assets purchased during the year.

Required:

(i) Write up the research and development, fixed asset and market research accounts to reflect the above transactions in the year ended 31 January 20X2.

(ii) Calculate the amount to be charged as research costs in the profit and loss account of Oxlag plc for the year ended 31 January 20X2.

(iii) State on what basis the company should amortise any capitalised development costs and what disclosures the company should make in respect of amounts written off in the year to 31 January 20X3.

(iv) Calculate the amounts to be disclosed in the balance sheet in respect of fixed assets, deferred development costs and work-in-progress.

(v) State what disclosures you would make in the accounts for the year ended 31 January 20X2 in respect of the new improved drug developed under project C, assuming sales begin on 1 May 20X2, and show strong growth to the date of signing the accounts, 14 July 20X2, with the expectation that the new drug will provide 25% of the company’s pre-tax profits in the year to 31 January 20X3.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273712312

12th Edition

Authors: Barry Elliott, Jamie Elliott