The following five-year summary relates to Wandafood Products plc and is based on financial statements prepared under

Question:

The following five-year summary relates to Wandafood Products plc and is based on financial statements prepared under the historical cost convention:

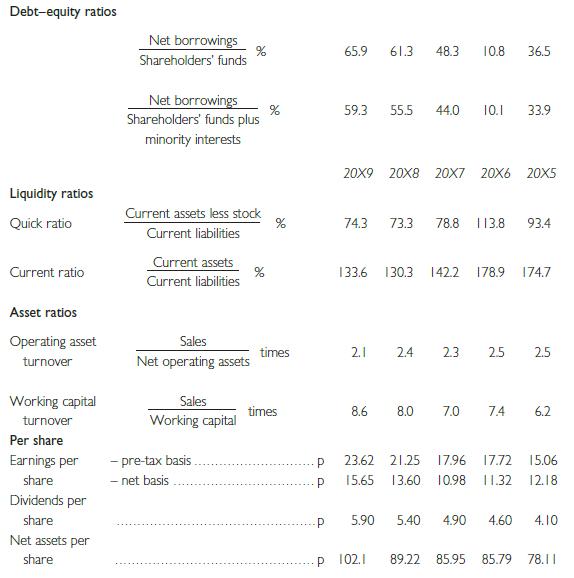

738 • Interpretation Financial ratios 20X9 20X8 20X7 20X6 20X5 Profitability Trading profit Margin Sales

% 7.8 7.5 7.0 7.2 7.3 Trading profit Return on assets Net operating assets

% 16.3 17.6 16.2 18.2 18.3 Interest and dividend cover Trading profit Interest cover Net finance charges times 2.9 4.8 5.1 6.5 3.6 Earnings per ordinar y share Dividend cover Dividend per ordinar y share times 2.7 2.6 2.1 2.5 3.1

Net operating assets include tangible fixed assets, stock, debtors and creditors. They exclude borrowings, taxation and dividends.

Required:

Prepare a report on the company, clearly interpreting and evaluating the information given.

(ACCA)

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273712312

12th Edition

Authors: Barry Elliott, Jamie Elliott