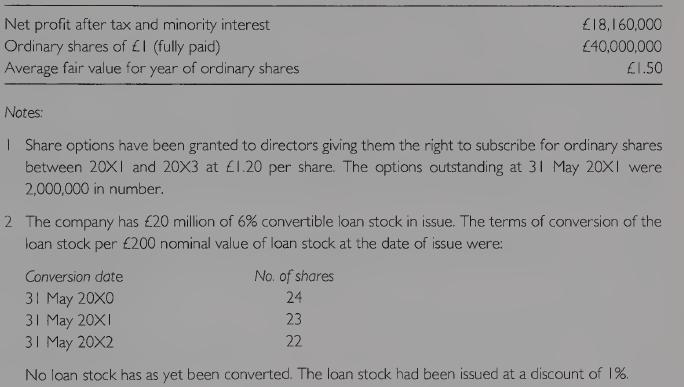

The following information is available for X Ltd for the year ended 3 I May 20XI: 3

Question:

The following information is available for X Ltd for the year ended 3 I May 20XI:

3 There are 1,600,000 convertible preference shares in issue classified as equity. The cumulative dividend is I Op per share and each preference share can convert into two ordinary shares. The preference shares can be converted in 20X2.

4 Assume a corporation tax rate of 33% when calculating the effect on income of converting the convertible loan stock.

Required:

(a) Calculate the diluted EPS according to IAS 33.

(b) Discuss why there is a need to disclose diluted earnings per share.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting And Reporting

ISBN: 9780273778172

16th Edition

Authors: Mr Barry Elliott, Jamie Elliott

Question Posted: