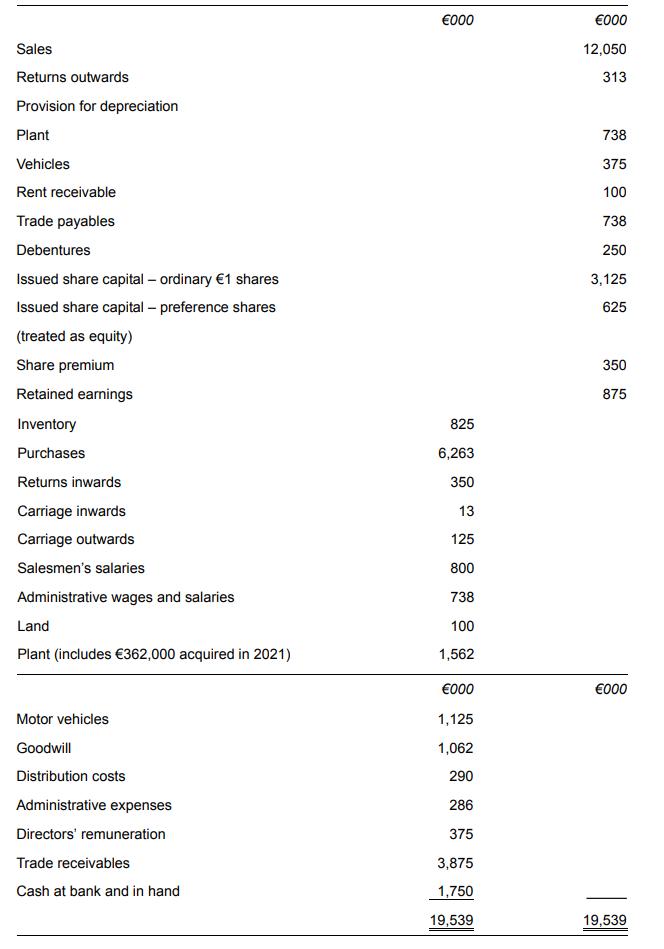

The following trial balance was extracted from the books of Old NV on 31 December 2021. (a)

Question:

The following trial balance was extracted from the books of Old NV on 31 December 2021.

(a) Provide for:

(i) An audit fee of €38,000.

(ii) Depreciation of plant at 20% straight-line.

(iii) Depreciation of vehicles at 25% reducing balance.

(iv) The goodwill suffered an impairment in the year of €177,000.

(v) Income tax of €562,000.

(vi) Debenture interest of €25,000.

(b) Closing inventory was valued at €1,125,000 at the lower of cost and net realisable value.

(c) Administrative expenses were prepaid by €12,000.

(d) Land was to be revalued by €50,000.

Required:

(a) Prepare a statement of profit for internal use for the year ended 31 December 2021.

(b) Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 and a statement of financial position as at that date in Format 1 style of presentation.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9781292399805

20th Edition

Authors: Barry Elliott, Jamie Elliott