The Piano Warehouse Company Limited was established in the UK on 1 January 20X7 for the purpose

Question:

The Piano Warehouse Company Limited was established in the UK on 1 January 20X7 for the purpose of making pianos. Jeremy Holmes, the managing director, had 20 years’ experience in the manufacture of pianos and was an acknowledged technical expert in the field. He had invested his life’s savings of £15,000 in the company, and his decision to launch the company reflected his desire for complete independence.

Nevertheless, his commitment to the company represented a considerable financial gamble. He paid close attention to the management of its financial affairs and ensured that a careful record of all transactions was kept.

At the end of the company’s first financial year, Jeremy Holmes was anxious that the company’s net profit to 31 December 20X7 should be represented in the most accurate manner. There appeared to be several alternative bases on which the transactions for the year could be interpreted. It was clear to him that, in simple terms, the net profit for the year should be calculated by deducting expenses from revenues. As far as cash sales were concerned he saw no difficulty.

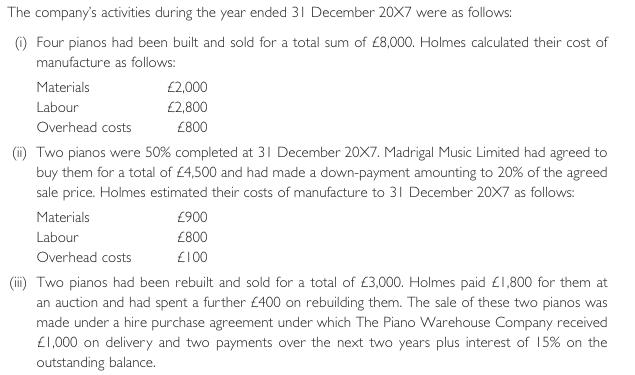

But how should the pianos that were 50% completed be treated? Should the value of the work done up to 31 December 20X7 be included in the profit of that year, or should it be carried forward to the next year, when the work would be completed and the pianos sold? As regards the pianos sold under the hire purchase agreement, should profit be taken in 20X7 or spread over the years in which a proportion of the revenue is received?

Required:

(a) Prepare a statement of comprehensive income for the year ended 31 December 20X7 on a basis that would reflect conventional accounting principles.

(b) Examine the problems implied in the timing of the recognition of revenues, illustrating your answer by the facts in the case of The Piano Warehouse.

(c) Discuss the significant accounting conventions that would be relevant to profit determination in this case, and discuss their limitations in this context.

(d) Advise the company on alternative accounting treatments that could increase the profit for the year.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273730040

13th Edition

Authors: Barry Elliott, Jamie Elliott