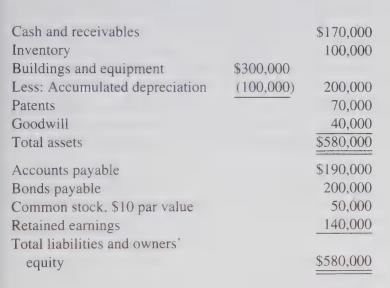

Amortization of Intangibles At January 1, 2001, Film Corporation reported the following balance sheet amounts: Buildings and

Question:

Amortization of Intangibles At January 1, 2001, Film Corporation reported the following balance sheet amounts:

Buildings and equipment have been depreciated for four years on a straight-line basis and have no estimated salvage value. Patents have 10 years of remaining life and goodwill has been amortized for 2 years of its expected 10-year life.

During 2001, Film Corporation spent $80,000 for research and development activities on a new production process that Film Corporation thinks will result in substantial cost savings over the next 10 years.

What dollar amount of expense should be reported in the 2001 income statement for each of the following?

a. Depreciation.

b. Amortization of patents.

c. Amortization of goodwill.

d. Research and development costs.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith