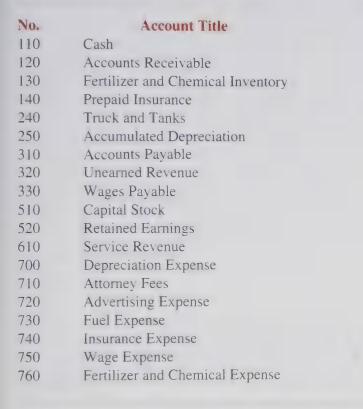

Comprehensive Problem Pamper Lawn Service is started on March 1, 2000. It established the following chart of

Question:

Comprehensive Problem Pamper Lawn Service is started on March 1, 2000. It established the following chart of accounts for its accounting system:

a. Record in general journal form entries for each of the following transactions and adjustments. Service Revenue is recorded as services are provided.

1. Capital stock is issued for $40,000 on March I. A total of $30,000 is spent immediately to purchase a used lawn-service truck and fertilizer tank.

2. In March, a bill for $200 is received from an attorney for drawing up the incorporation papers and helping apply for licenses. The bill is not paid immediately.

3. In March, $400 is paid to the local newspaper to run a series of ads promoting Pamper Lawn Service and offering a discount for early sign-up.

4. In April, $300 is paid for another series of newspaper ads.

5. In April, a $50 deposit is received from each of 100 customers who contracted for services for the summer. These deposits are considered to be payment for the initial inspection and the first month of treatment.

Inspections and the first month of treatment are scheduled for April and May. After the first month, routine monthly treatments are $40 per month.

6. A payment of $1,200 is made for insurance coverage on equipment and business liability.

7. On April 15, a shipment of fertilizer and chemicals is received, along with a bill for $5,000.

8. Twenty customers from (5) above receive their lawn inspection and first monthly treatment in April.

9. The remainder of the customers in (5) receive their inspection and first treatment in May. The initial twenty are billed an additional $40 for a second treatment in May.

10. In June, 100 customers are billed $40 each for the lawn treatment.

11. In June, $3,000 is received from customers in payment for their lawn services previously billed.

12. $3,500 is paid on account to the supplier of fertilizer and chemicals.

13. Wages of $2,600 are paid to employees.

14. On June 28, a bill for $500 for fuel used in the company truck is received and immediately paid.

15. Depreciation expense for the four-month period is based on expected lives of ten years for the truck and fertilizer tank.

16. A total of 60 percent of the fertilizer and chemicals received in April is used during the period ended June 30.

17. The insurance policy covers a twelve-month period beginning March 1.

18. Wages owed to employees for work completed prior to the end of June are $600. Payment will be made in July.

. Create the appropriate general ledger T-accounts and post the entries to the T-accounts.

. Prepare an adjusted trial balance as of June 30.

. Prepare an income statement and statement of changes in owners’ equity for Pamper Lawn Service for the fourmonth period ending June 30, 2000, and a balance sheet as of June 30.

. On June 30, 2000, the owners of the Pamper Lawn Service receive an offer to buy the business, including all customer contracts, equipment, and supplies as of July 1, 2000, for a price of $50,000. The owners agree that they do not have the time to expand the business beyond the current 100 customers, but they can keep operating at the current level. The buyers plan to expand the operations.

Should the owners sell? Why or why not?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith