Conversion from Cash to Accrual Tucker Corporation had the following cash receipts and payments in the month

Question:

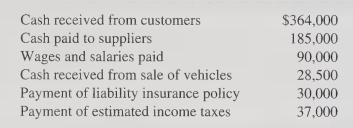

Conversion from Cash to Accrual Tucker Corporation had the following cash receipts and payments in the month of November:

In reviewing its accounting records for November, the chief accountant found the following:

1. Cash received from customers during November included collections of $26,000 from sales in October. Sales totaling $47,000 made on account during November will be collected in December.

2. Cash payments to suppliers in November included $21,000 for merchandise purchased in November but unsold at the end of the month. Payments to suppliers in October included $17,000 for merchandise sold in November.

3. Wage and salary payments made in November included payment of $9,000 for wages earned by employees in October. Unpaid wages earned by employees at the end of November were $13,000.

4, Vehicles sold in November had a carrying value of $16,500 on Tucker’s books at the time of sale.

5. A 12-month liability insurance policy was paid in advance on November 1. Tucker had no insurance coverage prior to November 1.

Prepare an accrual-basis income statement for November for Tucker Corporation.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith