Creassos Ltd was formed in July 2000 with 20,000 of capital. 7,500 of this was used to

Question:

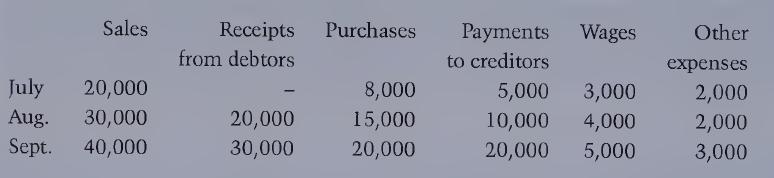

Creassos Ltd was formed in July 2000 with £20,000 of capital. £7,500 of this was used to purchase equipment. The owner budgeted for the following:

Wages and other expenses are paid in cash. In addition to the above, depreciation is £2,400 per annum. No inventory is held by the company.

• Calculate the profit for each the three months from July to September and in total.

• Calculate the cash balance at the end of each month.

• Prepare a Balance Sheet at the end of September.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting For Managers Interpreting Accounting Information For Decision Making

ISBN: 9780470777640

3rd Edition

Authors: Paul M. Collier

Question Posted: