Current Liabilities Rubin Corporation operates on a calendar-year basis. At December 1, 2001, Rubin reported the following

Question:

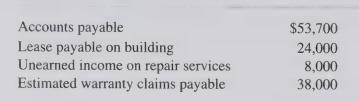

Current Liabilities Rubin Corporation operates on a calendar-year basis. At December 1, 2001, Rubin reported the following current liabilities:

During December 2001, the following events occurred:

1. Rubin purchased equipment at a cost of $36,000 on account, payable January 15, 2002. A bill for freight charges of $4,000 was received and must be paid by January 7, 2002.

2. Rubin purchased inventory for $87,500 on account.

3. Rubin made payments of $82,000 on account.

4. Rubin borrowed $60,000 from a local bank on December 1 at 8 percent annual interest. Principal and interest are due 6 months from the date of the loan.

5. Rubin owed | month’s payment on the building it leases at the beginning of December and failed to make any payments during the month. The building lease has 3 years remaining and equal monthly payments are required.

6. Rubin earned one-half of the income for repair services that had been prepaid by customers on November 30.

7. Rubin’s products are sold with a 4-year warranty. The company records its warranty expense for the year in the month of December and estimates warranty expense for 2001 to be $19,000. During December, Rubin paid $3,200 in warranty claims.

8. Employees of the company are paid a total of $1,650 per day. Two work days elapsed between the last payday and the end of the fiscal year.

Rubin has $300,000 par value 10 percent bonds outstanding.

The bonds were issued October 1, 1992, at par and mature on October 1, 2002. Interest is paid semiannually at April 1 and October 1.

a. Prepare the current liability section of Rubin’s balance sheet at December 31, 2001.

b. Explain your treatment of the bonds outstanding.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith