Financial Reporting Measures Tripod Industries uses the last-in, first-out inventory costing method in accounting for its purchases

Question:

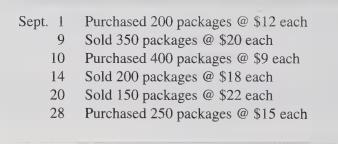

Financial Reporting Measures Tripod Industries uses the last-in, first-out inventory costing method in accounting for its purchases of cameras and film. On September 1, Tripod had 300 packages of professional-quality film on hand at a cost of $10 per package. Purchases and sales in September were:

a. Compute cost of goods sold and ending inventory for September if Tripod uses a periodic inventory system.

b. By what amount would cost of goods sold have been more or less if Tripod had used the first-in, first-out method of costing its inventory?

c. The controller of Tripod is interested in computing cost of goods sold and inventory balances on a more frequent basis as a means of improving the information available for decision making. Assuming Tripod costs its inventory on a LIFO basis using a perpetual inventory system, compute cost of goods sold and ending inventory for September.

d. Compare the results from using last-in, first-out for the period overall in part a and those using perpetual computations in part

c. What is the amount of the change? What causes this difference? Which method more accurately measures operating results? Should an external decision maker care whether a company uses a perpetual or periodic inventory system? Explain.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith