Goodwill Bristol Company recently purchased General Enterprises to expand its dealer network to the west coast. Just

Question:

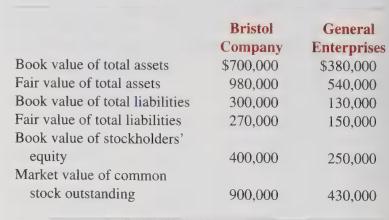

Goodwill Bristol Company recently purchased General Enterprises to expand its dealer network to the west coast. Just before the acquisition, the following dollar amounts were reported by the two companies:

After the acquisition, General’s assets and liabilities were transferred to Bristol and recorded on Bristol’s books. Bristol issued new preferred shares with a market value of $450,000 and par value of $350,000 in making the purchase.

a. What was the fair value of the net assets of General Enterprises when the company was acquired by Bristol? Why was the market price of General’s stock more than the fair value of its net assets?

b. Why would Bristol pay more than the current market price of General’s stock to make the acquisition?

c. What amount of goodwill would be reported by Bristol at the time of the purchase? What other accounts would be affected on Bristol’s books by the acquisition and by what amounts?

d. How must Bristol treat the goodwill for financial reporting purposes at the time of the acquisition and in subsequent years?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith