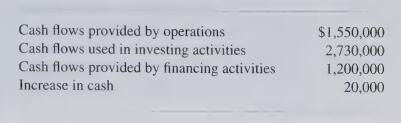

Identifying Information You have been provided with limited summary information from the Wright Equipment Company. For each

Question:

Identifying Information You have been provided with limited summary information from the Wright Equipment Company. For each of the following questions, indicate what additional information you would need to answer the questions. Also, identify the financial statement or note where you would expect to find the information needed.

Questions:

a. What proportion of the cash flows from operations was provided by delaying payments on trade accounts payable?

b. What percentage of cash needs were provided by issuing debt?

c. Is cash flow per share high enough to assure the safety of cash dividends?

d. Has total cash flow increased this year?

e. What is the cash return on assets (operating cash flow to total assets) for the company?

f. Does cash flow from operations provide sufficient cash to maintain assets?

g. Do operating cash flows provide a reasonable margin of safety for payment of cash dividends?

h. Is the company generating enough cash from operations to repay debt commitments that mature in the near future? Is cash generated from operations enough to pay normal trade payables on a timely basis?

i. How does the ratio of cash flow to total debt compare to last year?

j. Are deferred taxes increasing? What does this mean for cash flows provided by operations?

k. What are the requirements for interest payments this year?

Were operating cash flows sufficient to cover these payments?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith