Income Statement Preparation Bill Braddock started a small business in 1999 with rented equipment and soon found

Question:

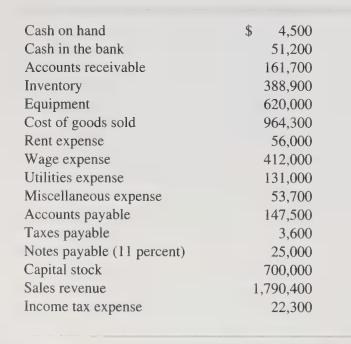

Income Statement Preparation Bill Braddock started a small business in 1999 with rented equipment and soon found that his business was booming. After a successful 1999, Bill decided to invest additional money so the company could purchase equipment and additional inventory. Selected account balances for the Braddock Corporation at the end of 2000 are as follows:

All of Braddock’s equipment was purchased on July 1, 2000, and is expected to have a ten-year life with no residual value.

The note payable to the bank was taken out on December 31, 1999, and is due on June 30, 2001. Braddock has not recorded any interest on the note because no principal or interest payments are due until the note matures. Braddock also has left unrecorded $1,500 of wages that will be paid to employees in 2001 for work performed in 2000. The recorded rent expense includes $4,000 rent that has been prepaid for 2001. Now Bill wants to know how his company is doing.

a. Prepare a formal income statement for Braddock for 2000 in accordance with generally accepted accounting principles.

b. How does Braddock Corporation seem to be doing? Explain.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith