Intangible Assets Scenter Company is considering purchasing the net assets of Ripple Corporation. Ripples reported net assets

Question:

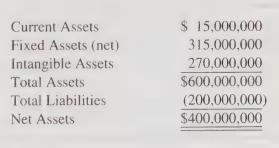

Intangible Assets Scenter Company is considering purchasing the net assets of Ripple Corporation. Ripple’s reported net assets are as follows:

Ripple’s fixed assets are depreciated on a straight-line basis over 15 years with no estimated salvage value. The intangible assets reported by Ripple consist of patent rights with an expected life of 5 years and goodwill that is expected to be of benefit during the next 10 years.

a. How must intangible assets be reported for financial reporting purposes? In Ripple’s income statement, is depreciation expense on its tangible assets or amortization of its intangible assets likely to be greater? Explain.

b. In evaluating how much it should be willing to pay for Ripple, what value should Scenter place on Ripple’s fixed assets? What value should it place on the patent rights held by Ripple?

c. How did the goodwill reported by Ripple arise? If goodwill is not an identifiable asset that can be sold, why is it recorded?

d. How will Scenter determine the amount of goodwill to be recorded when it purchases Ripple’s net assets? Will the amount of goodwill recorded by Scenter be equal to the amount of goodwill currently reported by Ripple? Explain.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith