Inventery Transactions Martie Company had a beginning inventory of 100 units with a cost of $17 each.

Question:

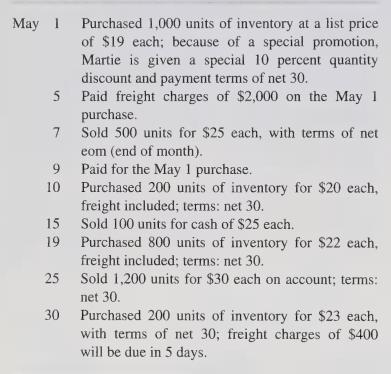

Inventery Transactions Martie Company had a beginning inventory of 100 units with a cost of $17 each. During May, the company engaged in the following transactions:

Martie Company uses a perpetual inventory system, computing its cost of goods sold for each sale and its new inventory balance after each inventory transaction. The company assigns inventory costs on a FIFO basis.

a. Prepare a schedule showing the computation of Martie’s cost of goods sold for May.

b. Prepare a schedule showing the composition of Martie’s inventory at the end of May.

c. If Martie assigned inventory costs on a LIFO basis rather than FIFO, compute the company’s cost of goods sold and ending inventory for May.

d. If Martie assigned inventory costs on a moving-average basis, recomputing the average cost of its inventory after each purchase, compute the company’s cost of goods sold and ending inventory for May.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith