Inventory Cost Flow Assumptions The Comfort Zone Bed Company started its business on January 1, 2000, with

Question:

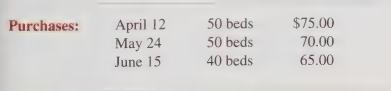

Inventory Cost Flow Assumptions The Comfort Zone Bed Company started its business on January 1, 2000, with an inventory of 40 beds purchased for $80 each. During the first six months of operations Comfort Zone sold 130 beds for $120 each. Comfort Zone is interested in obtaining a bank loan to expand its operations. The bank wants information on Comfort Zone’s sales, inventory balances, and gross profit before approving the loan. Comfort Zone has 50 beds on hand at June 30 and reports its inventory costs have been declining. The company provides the following information about inventory purchases during the first six months of operations:

a. Comfort Zone has not chosen an inventory cost flow assumption for its operations. To help it make a choice, determine the following information using FIFO, LIFO, and average inventory cost flow assumptions.

1. The inventory balance at June 30.

2. Cost of goods sold and gross profit for the six-month period.

3. Gross profit percentage and inventory turnover for the six-month period.

b. Which inventory cost flow assumption would be the most positive for obtaining the bank loan? Are there any disadvantages to its use?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith