Managing Financial Assets Snappy Biscuit Company reported the following financial assets in its balance sheets at December

Question:

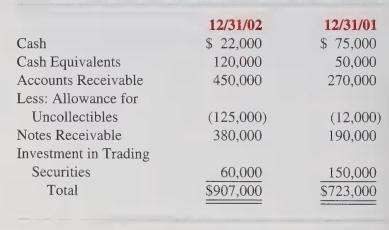

Managing Financial Assets Snappy Biscuit Company reported the following financial assets in its balance sheets at December 31, 2001 and 2002:

After reviewing the reported results, you are asked to respond to the following policy questions by the management of Snappy Biscuit Company:

a. During 2002, the company adopted a policy of investing all cash not expected to be needed within four working days. As a result, the reported cash balance has declined substantially and the controller has sometimes had to delay making payment on accounts payable because there was not enough cash in the checking account to cover checks that needed to be written that day. Evaluate the desirability of this policy.

b. Snappy has adopted a new compensation policy for sales representatives under which sales personnel are compensated based primarily on sales. The company is very pleased because sales increased from $750,000 to $1,650,000 during 2002. How would you evaluate the results of its change in policy? What negative effects might the policy have?

c. Because some of its customers have had trouble paying for their purchases promptly, Snappy adopted a policy in early 2002 of converting accounts receivable into notes receivable, with an annual interest rate of 5 percent, and allowing the companies to take advantage of their sales discounts. Snappy’s normal terms of sale are 2/10, n/30.

Evaluate the results of Snappy’s policy.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith