Minicase 2 Sears, Roebuck and Co.The income statements, selected balance sheet information, and selected note disclosuresfrom the

Question:

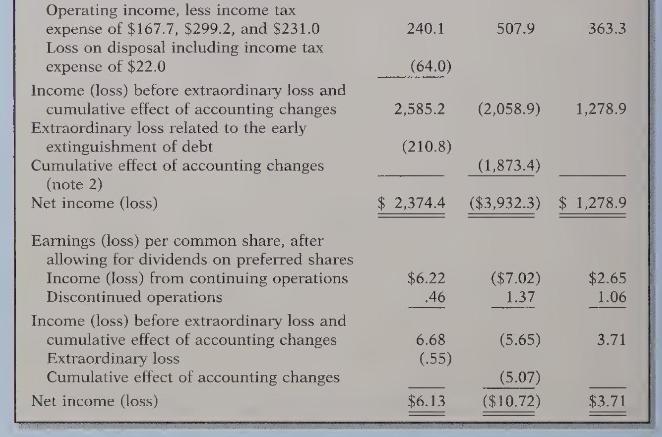

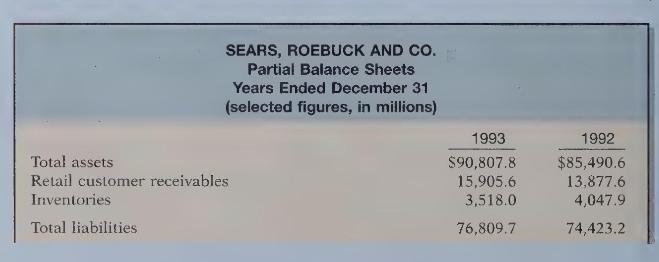

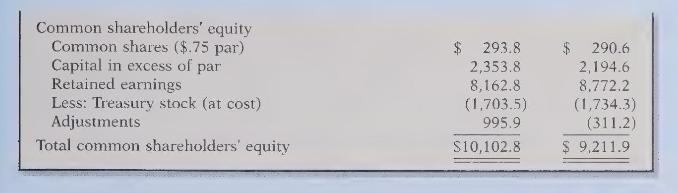

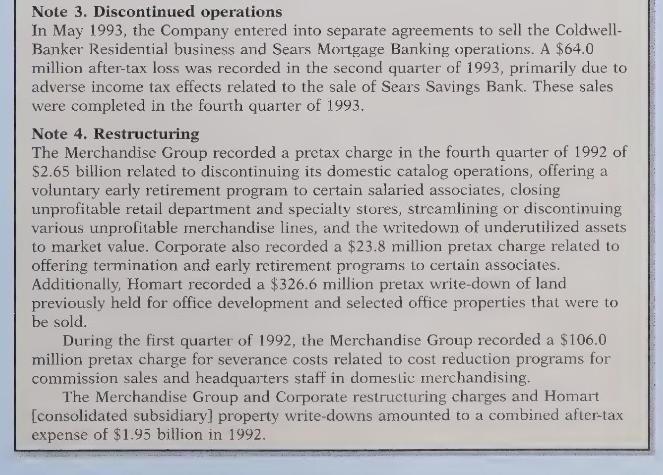

Minicase 2 Sears, Roebuck and Co.The income statements, selected balance sheet information, and selected note disclosuresfrom the annual report of Sears, Roebuck and Co. for 1993 are presented on the follow-ing pages.

Instructions

(a) Calculate the following ratios for 1993 and then evaluate Sears' profitability:(1) Profit margin for both income from continuing operations and net income(2) Return on common stockholders' equity(3) Return on assets(4) Times interest earned

(b) Sears showed a loss of \(\$ 1.65\) billion from Hurricane Andrew in 1992. In what cate-gory does the loss appear in Sears' 1992 income statement?

(c) Sears' revenues from its merchandising operations were \(\$ 26.29\) billion, and its costof sales was \(\$ 18.76\) billion in 1993 .(1) Calculate Sears' inventory turnover ratio for 1993 .(2) Suppose you wanted to compare Sears' inventory turnover ratio with that of aCanadian company, which under Canadian accounting standards must use FIFO.Would you be able to make such a comparison? If so, how?(3) Calculate Sears' receivables turnover ratio for 1993.(4) Unlike most retailers, whose fiscal year ends a month into the following year,Sear's year-end is December 31. What effect does Sears' year-end have on the in-ventory turnover and receivables turnover ratios?(5) What effect does Sears' nonstandard year-end (for a retailer) have on the com-parability of Sears' ratios with those of other large retailers?

(d) Sears sold two business segments in 1993.(1). What did it sell and in what quarter were these sales completed?(2) Where does the income or loss from these sales appear on Sears' income state-ment?

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471169192

1st Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso