Purchases Denominated in Foreign Currency Superior Lighting Company purchased light fixtures from a foreign company with the

Question:

Purchases Denominated in Foreign Currency Superior Lighting Company purchased light fixtures from a foreign company with the purchase price stated in FCU (foreign currency units). The products were received on November 1, 2000, at an agreed-upon price of 400,000 FCU.

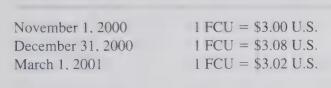

Payment is to be made on March 1, 2001. Superior Lighting Corporation’s year-end is December 31, 2000. Relevant exchange rates are as follows:

a. What amount should Superior Lighting record as the purchase price of the lighting fixtures at November 1, 2000?

b. What amount should Superior Lighting report as its accounts payable at December 31, 2000?

c. What amount of gain or loss on foreign currency transactions should Superior Lighting record at December 31, 2000?

d. What dollar amount should Superior Lighting report for its payment on March 1, 2001?

e. What amount of gain or loss on foreign currency ‘transactions should Superior Lighting record at March 1, 2001?

f. Was Superior Lighting better off or worse off from having delayed payment on its account until March 1, 2001, rather than paying on November 1, 2000? By what amount?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith