Quaker OatsThe Positive Side of Negative Cash Selected account balances reported in the balance sheet of Quaker

Question:

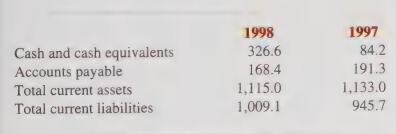

Quaker Oats—The Positive Side of Negative Cash Selected account balances reported in the balance sheet of Quaker Oats are as follows (in millions of dollars):

A footnote disclosure from the annual report describes the accounting for cash and cash equivalents:

Cash and Cash Equivalents—Cash equivalents are composed of all highly liquid investments with an original maturity of three months or less. As a result of the Company’s cash management system, checks issued but not presented to the banks for payment may create negative book cash balances. Such negative balances are included in trade accounts payable and totaled $40.8 million and $45.1 million as of December 31, 1998 and 1997, respectively.

Based on the information presented, answer the following questions:

a. The balance sheets indicated that Quaker Oats had positive cash balances, yet the footnote disclosures indicated negative cash balances. How can this be?

b. Explain in general terms the company’s cash management system as it relates to payments and the issuance of checks. Why does this lead to the confusion surrounding whether cash balances are positive or negative? (Hint: Draw a time line of events relating to the payment of invoices received and indicate the accounting entries the company makes at different points along the line.)

c. If the checks not yet presented to the banks for payment had not been reclassified as accounts payable, what cash balances would Quaker Oats have shown in its balance sheets? How would the amount of working capital reported each year have been different? How would the current ratios have been different each year?

d. Is the company’s reporting approach reasonable given the nature of its cash management system? Explain.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith