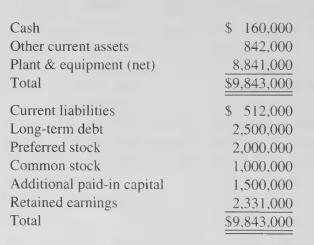

Return on Investment Danley Corporations balance sheet appears as follows: For the year just ended, Danley reported

Question:

Return on Investment Danley Corporation’s balance sheet appears as follows:

For the year just ended, Danley reported net income of $728,000. During the year, the company declared and paid preferred dividends of $160,000 and common dividends of $300,000.

a. Compute the following for Danley:

1. Return on assets.

2. Return on long-term capital (long-term debt and stockholders’ equity).

3. Return on stockholders’ equity.

4. Return on common equity.

b. If the company’s interest expense related to its long-term debt was $120,000 for the year, after taxes, and the longterm debt could have been replaced with $2,500,000 of common stock, what would the return on common equity have been for the year without debt financing? What does this imply about the desirability of this company using long-term debt? Will this always be true? Explain.

c. Suppose the company had issued the bonds shown in its balance sheet, but had issued an additional $2,000,000 of common stock rather than the preferred stock. What would the return on common equity have been? What does this imply about the desirability of this company using preferred stock?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith