Sale of Depreciable Asset Sunsweet Corporation purchased a building on January 1, 1991, for $900,000. It sold

Question:

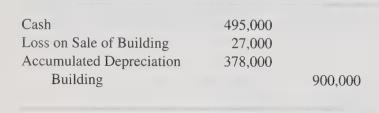

Sale of Depreciable Asset Sunsweet Corporation purchased a building on January 1, 1991, for $900,000. It sold the building on January 1, 2000, and made the following journal entry:

Sunsweet used straight-line depreciation and an expected life of 20 years in depreciating the asset.

a. What was the annual depreciation expense reported by Sunsweet?

b. What was the estimated salvage value used in recording the annual depreciation?

c. If Sunsweet reported net income of $270,000 prior to considering the effects of the sale of the building, what amount will it report as net income for the year 2000?

d. Give the journal entry that would have been recorded by Sunsweet if it had sold the building for $531,000 on January 1, 2000.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith