The bookkeeper for John Castle's Equipment Repair Corporation made these errors in journalizing and posting: 1. A

Question:

The bookkeeper for John Castle's Equipment Repair Corporation made these errors in journalizing and posting:

1. A credit posting of \(\$ 400\) to Accounts Receivable was omitted.

2. A debit posting of \(\$ 750\) for Prepaid Insurance was debited to Insurance Expense.

3. A collection on account of \(\$ 100\) was journalized and posted as a debit to Cash \(\$ 100\) and a credit to Service Revenue \(\$ 100\)

4. A credit posting of \(\$ 300\) to Property Taxes Payable was made twice.

5. A cash purchase of supplies for \(\$ 250\) was journalized and posted as a debit to Supplies \(\$ 25\) and a credit to Cash \(\$ 25\).

6. A debit of \(\$ 465\) to Advertising Expense was posted as \(\$ 456\).

\section*{Instructions}

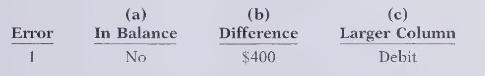

For each error, indicate

(a) whether the trial balance will balance; if the trial balance will not balance, indicate

(b) the amount of the difference, and

(c) the trial balance column that will have the larger total. Consider each error separately. Use the following form, in which error 1 is given as an example:

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471169192

1st Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso