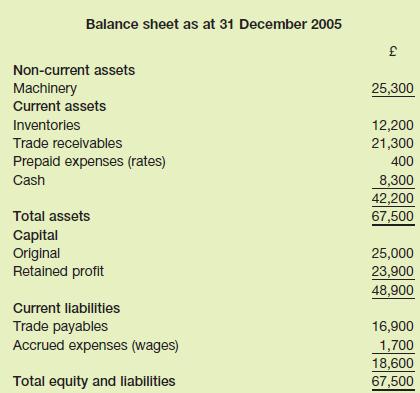

The following is the balance sheet of WW Associates as at 31 December 2005: During 2006, the

Question:

The following is the balance sheet of WW Associates as at 31 December 2005:

During 2006, the following transactions took place:

1 The owners withdrew capital in the form of cash of £23,000.

2 Premises were rented at an annual rental of £20,000. During the year, rent of £25,000 was paid to the owner of the premises.

3 Rates on the premises were paid during the year for the period 1 April 2006 to 31 March 2007 and amounted to £2,000.

4 Some machinery (a non-current asset), which was bought on 1 January 2005 for £13,000, has proved to be unsatisfactory. It was part-exchanged for some new machinery on 1 January 2006, and WW Associates paid a cash amount of £6,000. The new machinery would have cost £15,000 had the business bought it without the trade-in.

5 Wages totalling £23,800 were paid during the year. At the end of the year, the business owed £860 of wages.

6 Electricity bills for the four quarters of the year were paid totalling £2,700.

7 Inventories totalling £143,000 were bought on credit.

8 Inventories totalling £12,000 were bought for cash.

9 Sales revenue on credit totalled £211,000 (cost £127,000).

10 Cash sales revenue totalled £42,000 (cost £25,000).

11 Receipts from trade receivables totalled £198,000.

12 Payments to trade payables totalled £156,000.

13 Van running expenses paid totalled £17,500.

The business uses the reducing-balance method of depreciation for non-current assets at the rate of 30 per cent each year.

Required:

Prepare a balance sheet as at 31 December 2006 and an income statement (profit and loss

Step by Step Answer:

Financial Accounting For Decision Makers

ISBN: 9781405888219

5th Edition

Authors: Dr Peter Atrill, Eddie Mclaney, Sin Autor