The following is the statement of financial position of TT and Co. (see Self-Assessment Question 3.1 on

Question:

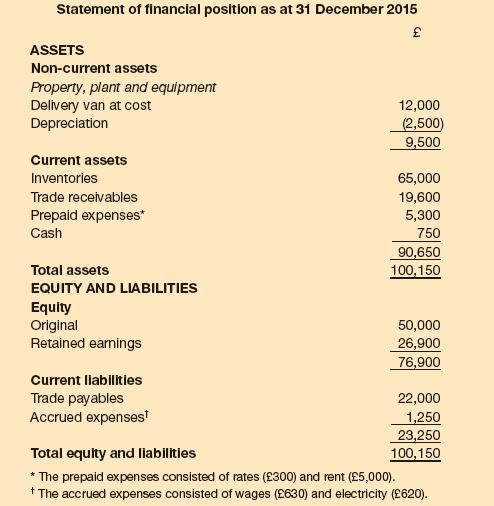

The following is the statement of financial position of TT and Co. (see Self-Assessment Question 3.1 on page 104) at the end of its first year of trading:

During 2016, the following transactions took place:

1 The owners withdrew £20,000 of equity as cash.

2 Premises continued to be rented at an annual rental of £20,000. During the year, rent of £15,000 was paid to the owner of the premises.

3 Rates on the premises were paid during the year as follows: for the period 1 April 2016 to 31 March 2017, £1,300.

4 A second delivery van was bought on 1 January 2016 for £13,000. This is expected to be used in the business for four years and then to be sold for £3,000.

5 Wages totalling £36,700 were paid during the year. At the end of the year, the business owed £860 of wages for the last week of the year.

6 Electricity bills for the first three quarters of the year and £620 for the last quarter of the previous year were paid totalling £1,820. After 31 December 2016, but before the financial statements had been finalised for the year, the bill for the last quarter arrived showing a charge of £690.

7 Inventories totalling £67,000 were bought on credit.

8 Inventories totalling £8,000 were bought for cash.

9 Sales revenue on credit totalled £179,000 (cost £89,000).

10 Cash sales revenue totalled £54,000 (cost £25,000).

11 Receipts from trade receivables totalled £178,000.

12 Payments to trade payables totalled £71,000.

13 Van running expenses paid totalled £16,200.

The business uses the straight-line method for depreciating non-current assets.

Required:

Prepare a statement of financial position as at 31 December 2016 and an income statement for the year to that date.

Step by Step Answer: