Use of Leverage Sarasota Enterprises has 50,000 shares of common stock outstanding and expects to report income

Question:

Use of Leverage Sarasota Enterprises has 50,000 shares of common stock outstanding and expects to report income before taxes of $51,000 in each of the next few years.

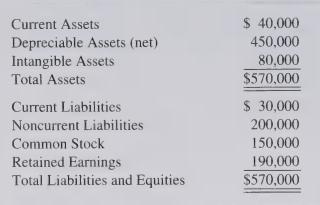

The company reported the following summarized balance sheet amounts at December 31, 2000:

To increase future income, Sarasota will need $300,000 of additional capital to expand its motel facilities. If it carries out the proposed expansion, it expects income before taxes and interest to increase to about $95,000 per year.

Sarasota must choose whether to issue bonds or shares of preferred or common stock to finance the expansion. The company’s income tax rate is 30 percent. If 20-year bonds are issued, they must yield 8 percent annually. If the company raises the $300,000 through the sale of preferred stock, 10,000 shares must be sold with a $3 per share annual dividend. A total of 8,000 shares of common stock must be sold to raise $300,000.

a. Under which financing alternative will the largest net income be reported?

b. Under which financing alternative will the largest income available to common shareholders be reported?

c. Under which financing alternative will the largest earnings per common share be reported?

d. What impact would the issuance of bonds have on debtto-equity and debt-to-asset ratios?

e. What impact would each of the financing alternatives have on return on total equity (net income divided by total stockholders’ equity) and the return on common equity (income available to common shareholders divided by common shareholders’ equity)?

f. Does the proposed expansion appear to be justified? Explain. If the expansion is justified, which financing alternative would you favor if you were a major common shareholder? Why?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith