Pantaloon Retail (India) Limited is the leading retailer of India operating through multiple retail formats. The company

Question:

Pantaloon Retail (India) Limited is the leading retailer of India operating through multiple retail formats. The company was incorporated in the year 1987 and went public during 1992 through its maiden initial public offer (IPO). Over a period of time, the company has established itself in Indian retail market both in value segment and in lifestyle segment. The company closes its accounts on 30th June every year.

During the year 1999–2000, the company carried out an exercise for valuation of its brand. In the notes to accounts the company stated that ‘the company based on the valuation report by an independent valuer has valued its brands at ₹ 11,770.0 lakh as at 30th June 2000. Accordingly, the brands have been shown in the fixed assets and credited the capital reserve. Since the expenditure in the earlier year and current year has been incurred towards brand building shown under the head deferred revenue expenditure, the balance amount of ₹ 11,71.25 lakh has been adjusted against capital reserve account.’

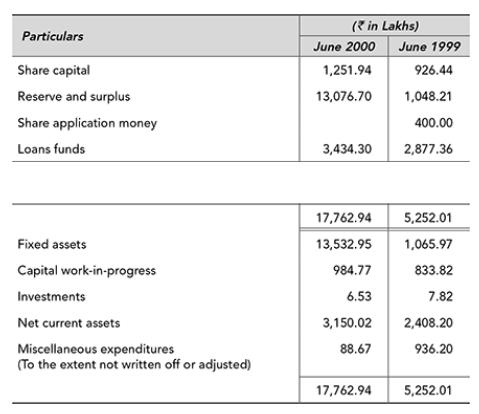

The summarized balance sheets as on 30th June 1999 and 2000 are given as follows:

The ICAI issued AS 26 ‘Intangible Assets’ with effect from 1st April 2003. AS 26 interalia provided that ‘Internally generated brands, mastheads, publishing titles, customer lists and items similar in substance should not be recognized as intangible assets’. Ind AS 38 also prohibits capitalization of internally generated brands, etc.

The company it its accounts for the year 2003–04 stated that ‘in terms of AS26 “Accounting for Intangible Assets” issued by the Institute of Chartered Accountants of India, selfgenerated brands cannot be capitalized. Accordingly, in compliance with AS26 the brands of ₹ 11,770.00 lakh have been eliminated with a corresponding debit of ₹ 10,598.75 lakh to the capital reserves and ₹ 11,71.25 lakh to the balance of Revenue Reserves’.

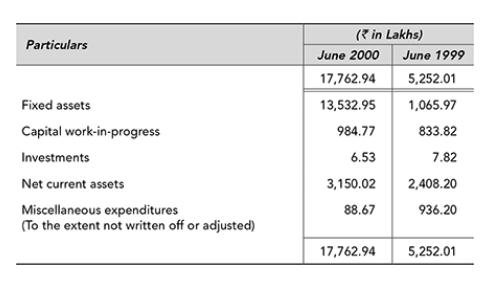

The impact of the above on the summarized balance sheets as on 30th June 2003 and 2004 is given as follows:

Questions for Discussion

1. Identify the impact of recognizing the brand value on the balance sheet as on 30th June 2000.

2. Identify the impact of writingoff the brand value on the balance sheet as on 30th June 2004.

3. How do you justify the AS 26 and Ind AS 38 prohibiting recognition of internally generated brands?

4. How is accounting for internally generated brands different from acquired brand?

Step by Step Answer: