At year end, Riverside Corporation announced that it would change its inventory valuation method from last-in, first-out

Question:

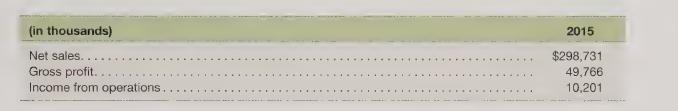

At year end, Riverside Corporation announced that it would change its inventory valuation method from last-in, first-out (LIFO) to first-in, first-out (FIFO). The company also disclosed that the inventory valuation policy change would have a “positive impact on gross profit by \($12.6\) million.” Presented below is Riverwood International’s originally reported (using LIFO) financial results for the year.

Describe the financial effects of this policy change on the company’s income statement, balance sheet, and statement of cash flow. Does the inventory method change materially impact the company’s reported income from operations?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris

Question Posted: