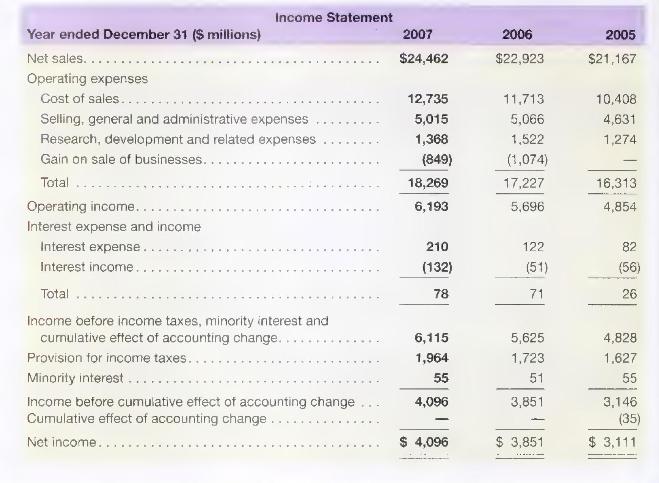

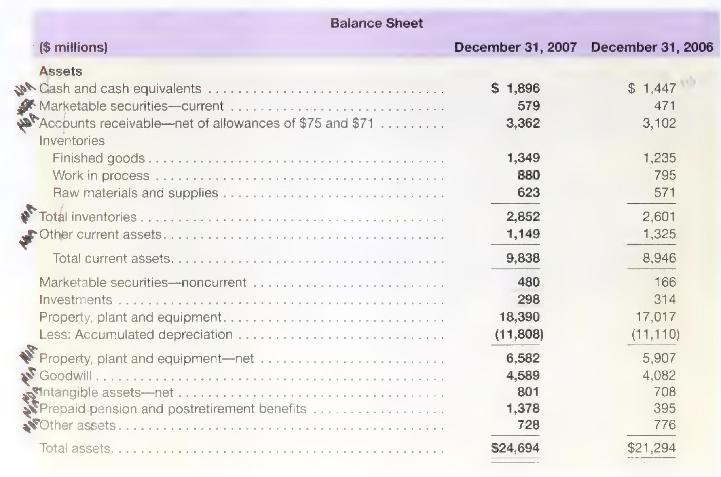

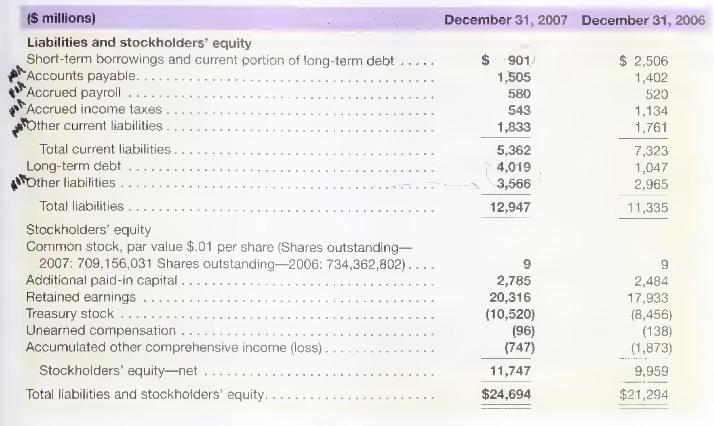

Balance sheets and income statements for (3 mathrm{M}) Company follow. section*{Required} a. Compute net operating profit after

Question:

Balance sheets and income statements for \(3 \mathrm{M}\) Company follow.

\section*{Required}

a. Compute net operating profit after tax (NOPAT) for 2007 and 2006. Assume that combined federal and state statutory tax rates are \(35.9 \%\) for 2007 and \(36.0 \%\) for 2006 .

b. Compute net operating assets (NOA) for 2007 and 2006

c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2007 and 2006; the 2005 NOA is \(\$ 12,776\) million. Has its RNOA improved or worsened? Explain why.

d. Compute net nonoperating obligations (NNO) for 2007 and 2006. Confirm the relation: \(\mathrm{NOA}=\) \(\mathrm{NNO}+\) Stockholders' equity.

e. Compute return on equity (ROE) for 2007 and 2006. (Stockholders' equity in 2005 is \(\$ 10,395\) million.)

f. What is the nonoperating return component of ROE for 2007 and 2006?

g. Comment on the difference between ROE and RNOA. What inference can we draw from this comparison?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally