Corning. Inc., reports the following stockholders' equity information in its (10-mathrm{K}) report.} In 2002, Corning issued...

Question:

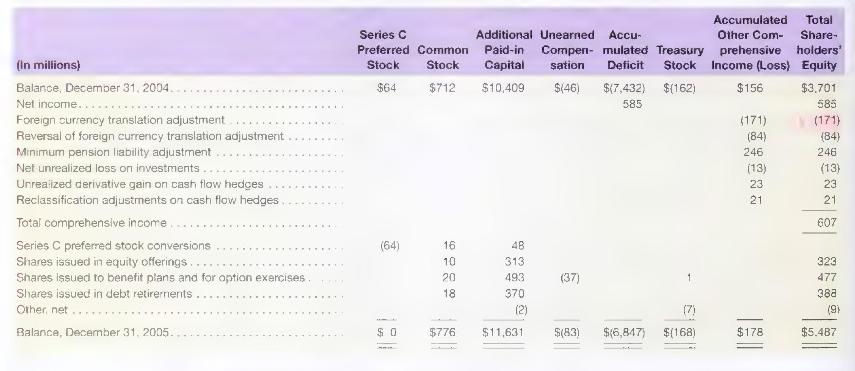

\\ Corning. Inc., reports the following stockholders' equity information in its \(10-\mathrm{K}\) report.}

In 2002, Corning issued 5.75 million shares of \(7.00 \%\) Series C Mandatory Convertible Preferred Stock. On the mandatory conversion date of August 15, 2005, the remaining outstanding shares were converted into Corning common stock at a conversion rate of 50,813 shares of common stock for each preferred share. Upon conversion of the preferred shares, we issued 31 million shares of Corning common stock resulting in an increase to equity of \(\$ 62\) million. The Series C Mandatory Convertible Preferred Stock had a liquidation preference of \(\$ 100\) per share, plus accrued and unpaid dividends.

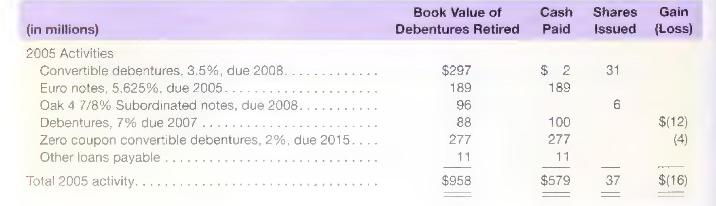

The following table summarizes the activities related to our debt retirements:

\section*{Required}

a. At December 31, 2004, Coming reports \(\$ 64\) million of \(7.00 \%\) Series C Mandatory Convertible Preferred stock. What is the dollar amount of dividends that Corning must pay on this stock? Some have argued that securities such as this are more like debt than equity. What is the basis for such an argument?

b. Describe the effects of conversion of the Series C Mandatory Convertible Preferred stock on Corning's balance sheet and its income statement.

c. Describe the effects on Coming's balance sheet and its income statement of the conversion of the Convertible debentures and of the Oak Subordinated notes.

d. What is the benefit, if any, to Corning of issuing debt and equity securities with a conversion feature? How are these securities treated in the computation of earnings per share (EPS)?

e. How do you interpret Corning's "Accumulated deficit"?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally