Equipment costing ($29,000), with a scrap value of ($5,000) was purchased on January 1, by Global Communications,

Question:

Equipment costing \($29,000\), with a scrap value of

\($5,000\) was purchased on January 1, by Global Communications, Inc. The estimated useful life of the equipment was four years and it was expected to generate 80,000 finished units of production. Units actually produced were 14,000 in 2014 and 20,000 in 2015.

Required

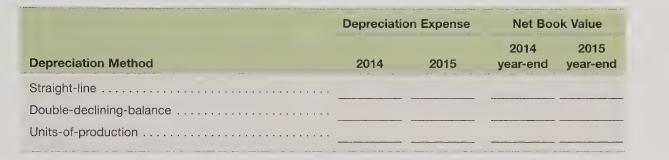

Complete the following table. Can the selection of a depreciation method affect a company’s asset replacement policy (i.e., the timing of its asset replacement)? If so, how?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris

Question Posted: