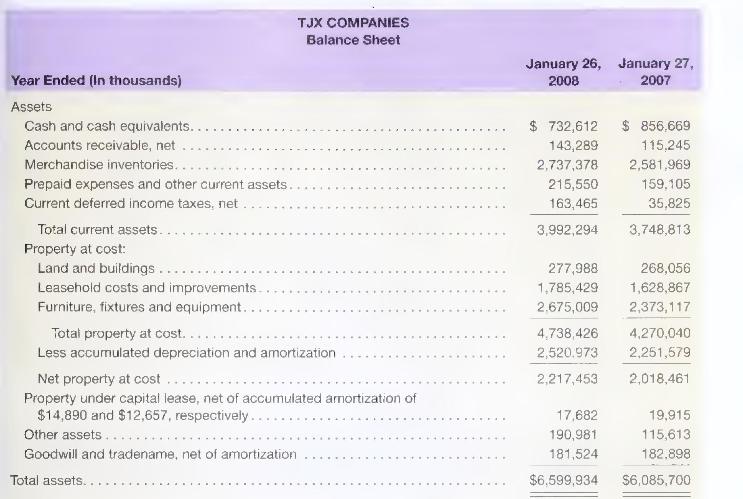

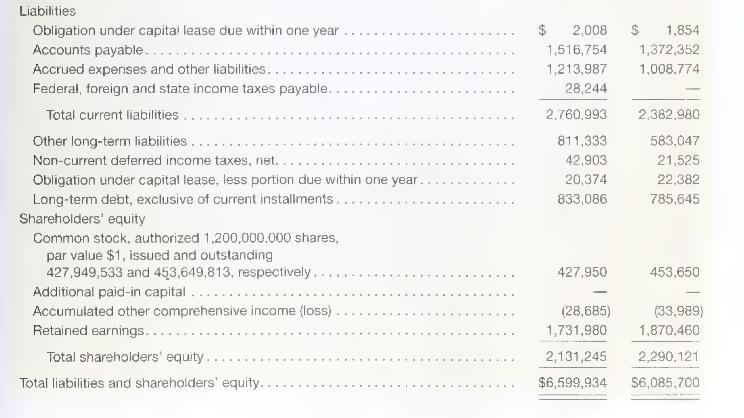

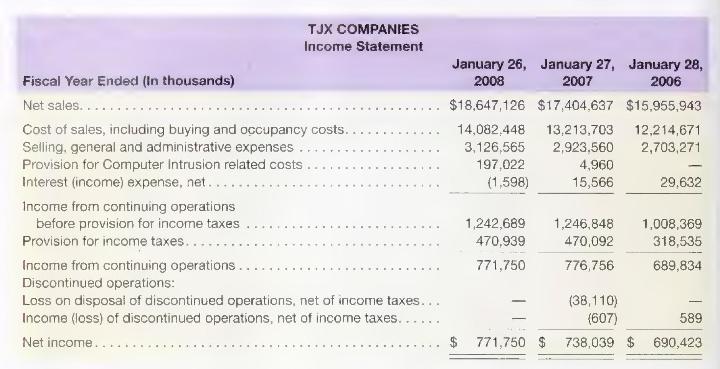

Following are the income statement and balance sheet for TJJ Companies. section*{Required} a. Compute net operating assets

Question:

Following are the income statement and balance sheet for TJJ Companies.

\section*{Required}

a. Compute net operating assets (NOA) as of January 26, 2008.

b. Compute net operating profit after tax (NOPAT) for fiscal year ended January 26, 2008, assuming a federal and state statutory tax rate of \(39.1 \%\).

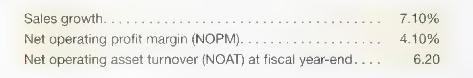

c. Forecast TJX's sales, NOPAT, and NOA for 2009 through 2012 using the following assumptions

Forecast the terminal period value assuming a \(1 \%\) terminal period growth and using the NOPM and NOAT assumptions above.

d. Estimate the value of a share of TJX common stock using the discounted cash flow (DCF) model as of January 26, 2008; assume a discount rate (WACC) of \(7 \%\), common shares outstanding of 427.9 million, and net nonoperating obligations (NNO) of \(\$ 856\) million.

e. TJX Companies' (TJX) stock closed at \(\$ 33.31\) on February 26, 2008. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally