Question:

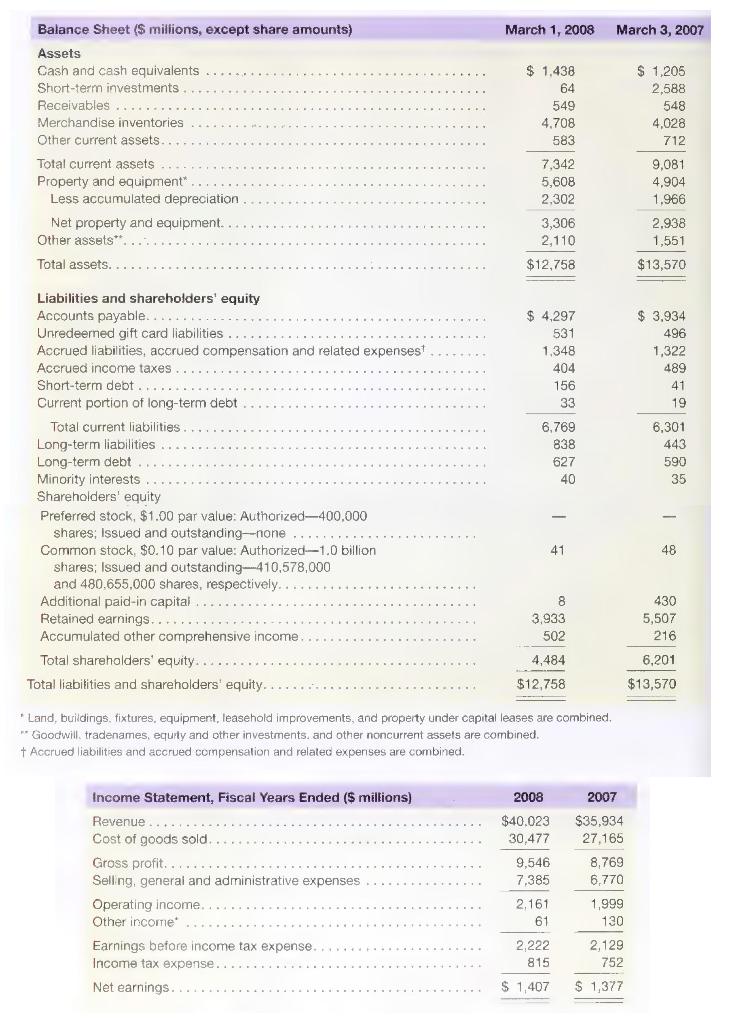

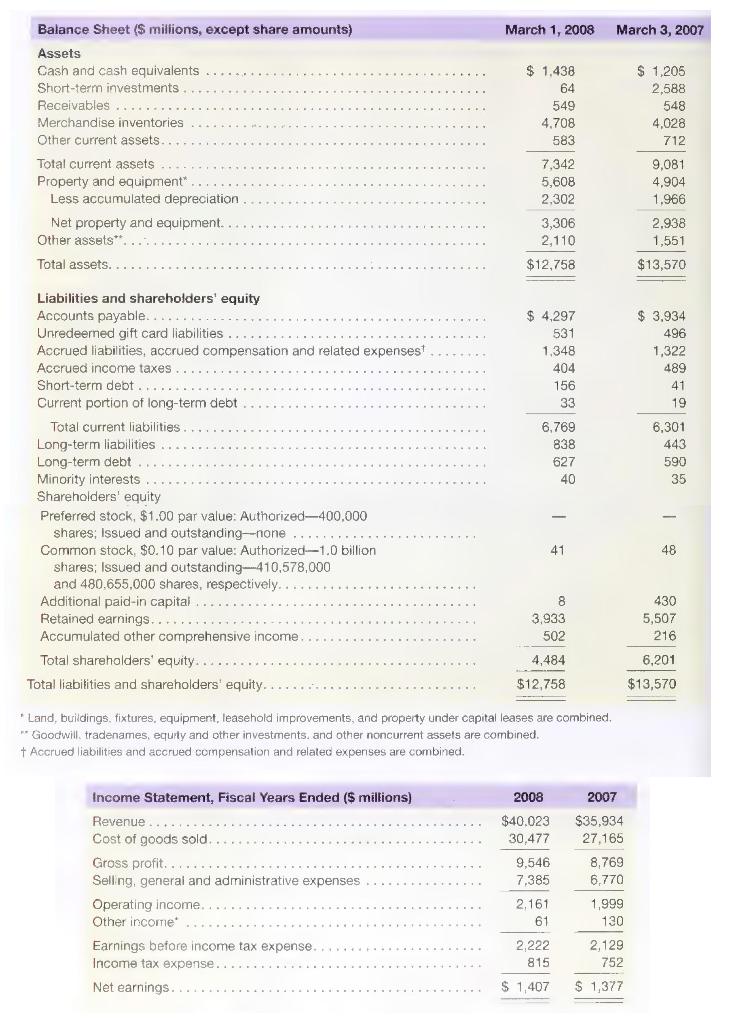

Following are the income statements and balance sheets of Best Buy Co., Inc.

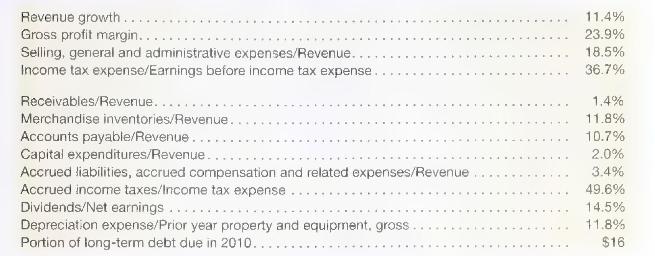

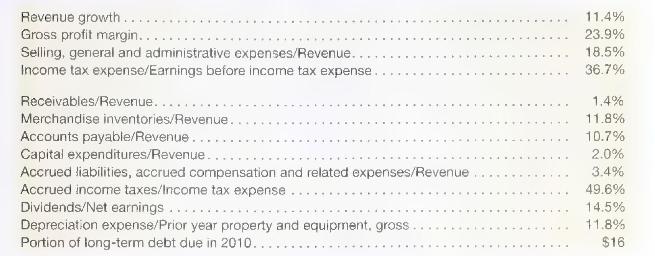

a. Forecast Best Buy's 2009 income statement and balance sheet using the following relations; assume no change for all other accounts not listed below. Assume that all capital expenditures are purchases of property and equipment, and that depreciation is included as part of selling, general and administrative expenses ( \(\$\) millions).

b. What does the forecasted cash balance from part \(a\) reveal to us about the forecasted financing needs of the company? Explain.

Transcribed Image Text:

Balance Sheet ($ millions, except share amounts) March 1, 2008 March 3, 2007 Assets Cash and cash equivalents Short-term investments.. Receivables.... Merchandise inventories Other current assets. Total current assets Property and equipment*... Less accumulated depreciation Net property and equipment. Other assets**. Total assets... Liabilities and shareholders' equity Accounts payable...... Unredeemed gift card liabilities...... Accrued liabilities, accrued compensation and related expenses Accrued income taxes Short-term debt... Current portion of long-term debt Total current liabilities.. Long-term liabilities Long-term debt Minority interests Shareholders' equity Preferred stock, $1.00 par value: Authorized-400,000 shares; Issued and outstanding-none...... Common stock, $0.10 par value: Authorized-1.0 billion shares; Issued and outstanding-410,578,000 and 480.655,000 shares, respectively.. Additional paid-in capital. Retained earnings... Accumulated other comprehensive income Total shareholders' equity...... Total liabilities and shareholders' equity... $ 1,438 64 549 4,708 $ 1,205 2,588 548 4,028 583 712 7,342 9,081 5,608 4,904 2,302 1,966 3,306 2,938 2,110 1,551 $12,758 $13,570 $ 4,297 $ 3.934 531 1,348 404 496 1,322 489 156 41 33 19 6,769 6,301 838 443 627 590 40 35 - 1 41 48 3,933 502 430 5,507 216 4,484 6,201 $12,758 $13,570 *Land, buildings, fixtures, equipment, leasehold improvements, and property under capital leases are combined. **Goodwill. tradenames, equity and other investments, and other noncurrent assets are combined. Accrued liabilities and accrued compensation and related expenses are combined. Income Statement, Fiscal Years Ended ($ millions) Revenue..... Cost of goods sold.. Gross profit.... Selling, general and administrative expenses Operating income.. Other income* Earnings before income tax expense. Income tax expense... Net earnings.... 2008 $40.023 30,477 2007 $35,934 27,165 9,546 8,769 7,385 6,770 2,161 1,999 61 130 2,222 815 2,129 752 $ 1,407 $ 1,377