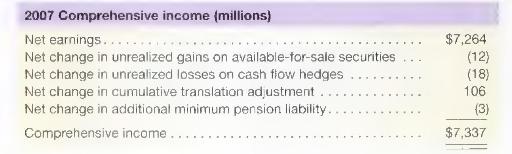

Hewlett-Packard reports the following schedule of comprehensive income (net income plus other comprehensive income) in its (200710-mathrm{K})

Question:

Hewlett-Packard reports the following schedule of comprehensive income (net income plus other comprehensive income) in its \(200710-\mathrm{K}\) report ( \(\$\) millions):

a. Describe how firms like Hewlett-Packard typically use derivatives.

b. How does HP report its derivatives designated as fair-value hedges and the hedged assets (and/or liabilities) on its balance sheet?

c. By what amount have the unrealized losses of \(\$(18)\) million on the cash flow hedges affected its current income? What are the analysis implications?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally

Question Posted: