Kellogg Co. reports the following table and discussion in its (200710-mathrm{K}) The following tables provide an analysis

Question:

Kellogg Co. reports the following table and discussion in its \(200710-\mathrm{K}\)

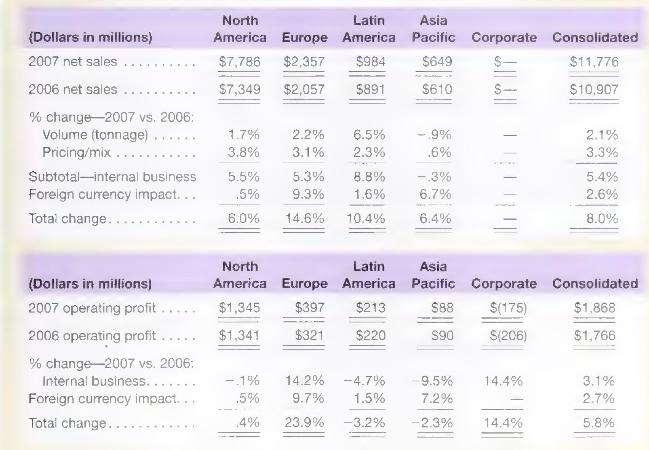

The following tables provide an analysis of net sales and operating profit performance for 2007 versus 2006:

\footnotetext{

Foreign exchange risk Our Company is exposed to fluctuations in foreign currency cash flows related to third-party purchases, intercompany loans and product shipments. Our Company is also exposed to fluctuations in the value of foreign currency investments in subsidiaries and cash flows related to repatriation of these investments. Additionally, our Company is exposed to volatility in the translation of foreign currency earnings to U.S. Dollars. Primary exposures include the U.S. Dollar versus the British Pound, Euro, Australian Dollar, Canadian Dollar, and Mexican Peso, and in the case of inter-subsidiary transactions, the British Pound versus the Euro. We assess foreign currency risk based on transactional cash flows and translational volatility and enter into forward contracts, options, and currency swaps to reduce fluctuations in net long or short currency positions. Forward contracts and options are generally less than 18 months duration. Currency swap agreements are established in conjunction with the term of underlying debt issuances.

}

a. How did foreign currency exchange rates affect sales and operating profit for Kellogg Co. in 2007?

b. Describe how the accounting for foreign exchange translation affects reported sales and profits

c. How does Kellogg Co. manage the risk related to its foreign exchange exposure? Describe the financial statement effects of this risk management activity.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally