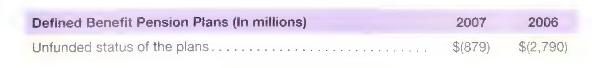

Lockheed Martin Corporation discloses the following funded status for its defined benefit pension plans in its (10-mathrm{K})

Question:

Lockheed Martin Corporation discloses the following funded status for its defined benefit pension plans in its \(10-\mathrm{K}\) report.

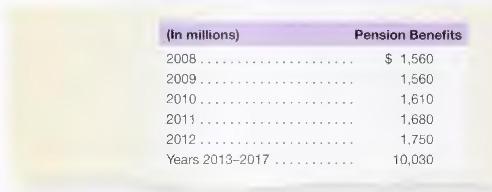

Lockheed contributed \(\$ 335\) million to its pension plan assets in 2007, down from \(\$ 693\) million in the prior year. The company also reports that it is obligated for the following expected payments to retirees in the next five years.

a. How is this funded status reported in Lockheed's balance sheet under current GAAP?

b. How should we interpret this funded status in our analysis of the company?

c. Lockheed projects payments to retirees of over \(\$ 1.5\) billion per year. How is the company able to contribute only \(\$ 335\) million to its pension plan?

d. What likely effect would a substantial decline in the financial markets have on Lockheed's contribution to its pension plans? Explain.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally