Question:

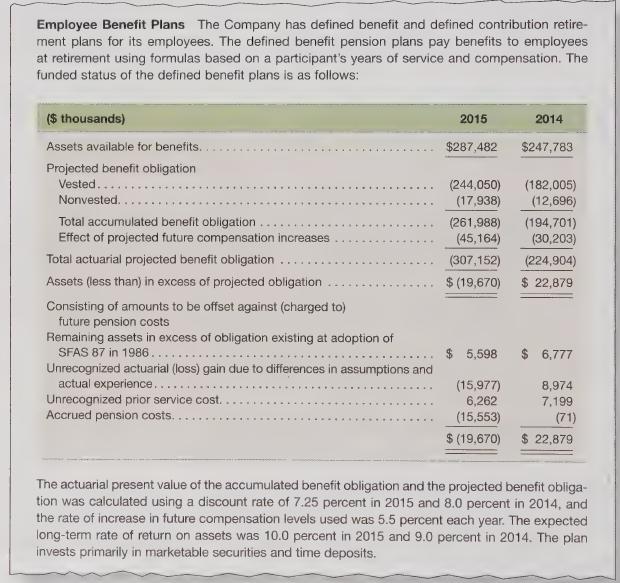

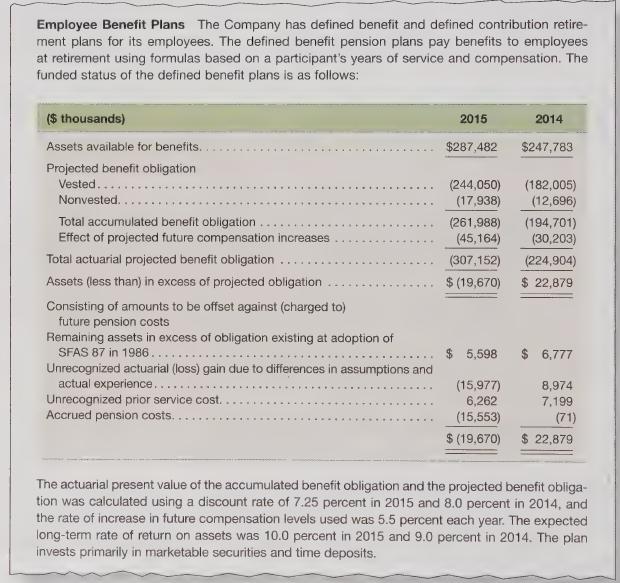

McGonagall, Inc. is a worldwide manufacturer of plastic parts.The company’s pension disclosures from its annual report were as follows:

Required

1. Identify the following values of 2014 and 2015:

a. Projected benefit obligation (PBO)

b. Pension plan assets Is McGonagall’s defined benefit plan over- or underfunded relative to its PBO? What financial statement adjustment would be required to fully reflect McGonagall’s pension asset/debt position on its balance sheet?

2. What was the financial effect on McGonagall’s PBO in 2015 when it lowered its discount rate from 8.00 percent in 2014 to 7.25 percent in 2015? What was the financial effect on McGonagall’s plan assets in 2015 when it raised its expected long-term rate of return from 9 percent in 2014 to 10 percent in 2015?

Do you agree with these changes?

Transcribed Image Text:

Employee Benefit Plans The Company has defined benefit and defined contribution retire- ment plans for its employees. The defined benefit pension plans pay benefits to employees at retirement using formulas based on a participant's years of service and compensation. The funded status of the defined benefit plans is as follows: ($ thousands) Assets available for benefits. Projected benefit obligation Vested... Nonvested.. Total accumulated benefit obligation Effect of projected future compensation increases Total actuarial projected benefit obligation Assets (less than) in excess of projected obligation Consisting of amounts to be offset against (charged to) future pension costs 2015 2014 $287,482 $247,783 (244,050) (182,005) (17,938) (12,696) (261,988) (194,701) (45,164) (30,203) (307,152) (224,904) $ (19,670) $ 22,879 Remaining assets in excess of obligation existing at adoption of SFAS 87 in 1986.. Unrecognized actuarial (loss) gain due to differences in assumptions and actual experience.... Unrecognized prior service cost. Accrued pension costs.. 5,598 $ 6,777 (15,977) 8,974 6,262 7,199 (15,553) (71) $ (19,670) $ 22,879 The actuarial present value of the accumulated benefit obligation and the projected benefit obliga- tion was calculated using a discount rate of 7.25 percent in 2015 and 8.0 percent in 2014, and the rate of increase in future compensation levels used was 5.5 percent each year. The expected long-term rate of return on assets was 10.0 percent in 2015 and 9.0 percent in 2014. The plan invests primarily in marketable securities and time deposits.