The Arcadia Company is contemplating a large capital investment of ($32) million in new productionline equipment, which

Question:

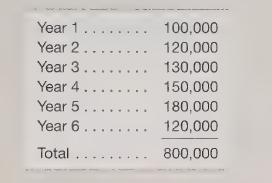

The Arcadia Company is contemplating a large capital investment of \($32\) million in new productionline equipment, which is expected to have a useful life of six years, a residual value of \($2\) million at retirement, and be good for 800,000 units of production. The company’s controller is uncertain whether the equipment should be depreciated using the straight-line method, the double-decliningbalance method, or the units-of-production method. The CEO suggested that a decision be made only after comparing the financial effects of the three methods. The anticipated production in units for the new equipment is as follows:

Required

Prepare a depreciation schedule for The Arcadia Company for the new equipment using each of the three methods of depreciation.

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris