The Best Buy 10-K report has the following footnote related to its leasing activities. section*{Required} a. What

Question:

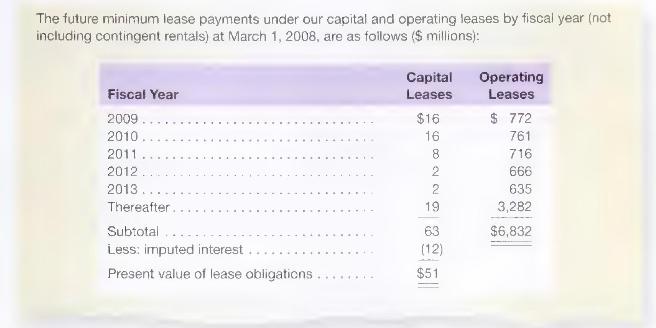

The Best Buy 10-K report has the following footnote related to its leasing activities.

\section*{Required}

a. What is the balance of the lease liabilities reported on Best Buy's balance sheet?

b. What effect has the operating lease classification had on its balance sheet? Over the life of the lease, what effect does this classification have on the company's net income?

c. Confirm that the implicit discount rate used by Best Buy for its capital leases is \(5.27 \%\). Use this discount rate to estimate the assets and liabilities that Best Buy fails to report as a result of its off-balance-sheet lease financing.

d. What adjustments would we make to Best Buy's income statement corresponding to the adjustments we made to its balance sheet in part \(c\) ?

e. Indicate the direction (increase or decrease) of the effect that capitalizing the operating leases would have on the following financial items and ratios for Best Buy: return on equity (ROE), net operating profit after tax (NOPAT), net operating assets (NOA), net operating profit margin (NOPM), net operating asset turnover (NOAT), and measures of financial leverage.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally