As Beacon Company controller, you are responsible for informing the board of directors about its financial activities.

Question:

As Beacon Company controller, you are responsible for informing the board of directors about its financial activities. At the board meeting, you present the following information.

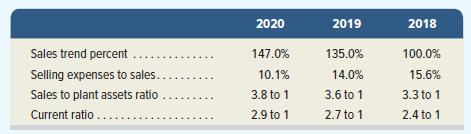

After the meeting, the company’s CEO holds a press conference with analysts in which she mentions the following ratios.

Required

1. Why do you think the CEO decided to report 4 ratios instead of the 11 prepared?

2. Comment on the possible consequences of the CEO’s reporting of the ratios selected.

2020 2019 2018 Sales trend percent 147.0% 135.0% 100.0% Selling expenses to sales... 10.1% 14.0% 15.6% Sales to plant assets ratio 3.8 to 1 3.6 to 1 3.3 to 1 Current ratio .. 2.9 to 1 2.7 to 1 2.4 to 1 Acid-test ratio 1.1 to 1 1.4 to 1 1.5 to 1 Inventory turnover 7.8 times 9.0 times 10.2 times Accounts receivable turnover 7.0 times 7.7 times 8.5 times Total asset turnover.. 2.9 times 2.9 times 3.3 times Return on total assets. 10.4% 11.0% 13.2% Return on stockholders' equity 10.7% 11.5% 14.1% Profit margin ratio.. 3.6% 3.8% 4.0%

Step by Step Answer:

The CEO may have chosen to report only four ratios instead of all 11 prepared by the controller for ...View the full answer

Financial Accounting Information For Decisions

ISBN: 9781260705584

10th Edition

Authors: John J. Wild

Related Video

Inventory turnover is a key metric that helps businesses evaluate the efficiency of their operations. A high turnover ratio is generally considered positive, indicating that the company is effectively selling its inventory and making efficient use of its resources. On the other hand, a low turnover ratio may indicate issues such as overstocking or slow sales and may require further examination to identify and address the underlying causes. Businesses use this ratio to make decisions about inventory levels, production schedules, and pricing strategies. It also helps businesses to identify areas where they may need to make improvements, such as reducing lead times for production or optimizing sales and marketing efforts. Additionally, inventory turnover is used by investors and analysts as a key performance indicator to evaluate the financial health and growth potential of a company.

Students also viewed these Business questions

-

sAs Beacon Company controller, you are responsible for informing the board of directors about its financial activities. At the board meeting, you present the following information. After the meeting,...

-

As an analyst for FinCorp Inc., you are responsible for many firms, including ADFC. Currently you have a hold recommendation on ADFC.18 the current price of ADFC is $140. You have conducted an...

-

As a quality control manager, you are responsible for checking the quality level of AC adapters for tablet PCs that your company manufactures. You must reject a shipment if you find 4 defective...

-

All administrative laws are criminal laws and enforceable as such even though they are not part of the Criminal Code. True False

-

Find the change of mass (in grams) resulting from the release of heat when 1 mol C reacts with 1 mol O2. C(s) + O2(g) CO2(g); H = 393.5 kJ

-

The chief executive officer of Ginny's Fashions has included the following financial statements in a loan application submitted to Priority Bank. The company intends to acquire additional equipment...

-

E 7-2 General problems Pang Corporation owns 80 percent interest in Sunda Corporation. On January 1, 2016, Sunda purchased $100,000 par of Pangs $1,000,000 outstanding bonds for $98,000 in the bond...

-

Northwest Sales had the following transactions in 2016: 1. The business was started when it acquired $200,000 cash from the issue of common stock. 2. Northwest purchased $900,000 of merchandise for...

-

Hi-Tech, Inc., reports net income of $70 million. Included in that number are depreciation expense of $6 million and a loss on the sale of equipment of $2 million Records reveal increases in accounts...

-

On January 1, 2024, Mitchell Company purchases new equipment for $700,000. Mitchell is required to make a down payment of $100,000 and issue an installment note for the remaining balance of $600,000....

-

Selected comparative financial statements of Korbin Company follow. Required 1. Compute each years current ratio. Round ratios to one decimal. 2. Express the income statement data in common-size...

-

Use the following selected data from Business Solutionss income statement for the three months ended March 31, 2021, and from its March 31, 2021, balance sheet to complete the requirements. Required...

-

Compare capital expenditures with marketable securities as an investment?

-

GATE 2024-EE Question

-

GATE 2024-EE Question

-

GATE 2024-EE Question

-

What is Netduino?

-

What is Appolonius theorem?

-

Presented below is information taken from a bond investment amortization schedule with related fair values provided. These bonds are classified as available-for-sale. Instructions a. Indicate whether...

-

Refer to the data for problem 13-36 regarding Long Beach Pharmaceutical Company. Required: Compute each division's residual income for the year under each of the following assumptions about the...

-

Refer to the information from QS 5-6. How will the break-even point in units change in response to each of the following independent changes in selling price per unit, variable cost per unit, or...

-

Refer to QS 5-6. Determine the (1) Contribution margin ratio and (2) Break-even point in dollars.

-

Refer to QS 5-6. Assume that BSD Phone Co. is subject to a 30% income tax rate. Compute the units of product that must be sold to earn after-tax income of $252,000.

-

The company sold merchandise to a customer on March 31, 2020, for $100,000. The customer paid with a promissory note that has a term of 18 months and an annual interest rate of 9%. The companys...

-

imer 2 0 2 4 Question 8 , PF 8 - 3 5 A ( similar to ) HW Score: 0 % , 0 of 1 0 0 points lework CH 8 Part 1 of 6 Points: 0 of 1 5 Save The comparative financial statements of Highland Cosmetic Supply...

-

An investor wants to purchase a zero coupon bond from Timberlake Industries today. The bond will mature in exactly 5.00 years with a redemption value of $1,000. The investor wants a 12.00% annual...

Study smarter with the SolutionInn App