Creassos Ltd. was formed in July 2012 with ($20,000) of capital. ($7,500) of this was used to

Question:

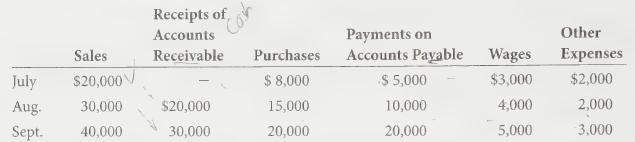

Creassos Ltd. was formed in July 2012 with \($20,000\) of capital. \($7,500\) of this was used to purchase equipment. The owner budgeted for the following:

Wages and other expenses are paid in cash. In addition to the above, depreciation is \($2,\) 400-per year.

No inventory is held by the company.

a. Calculate the profit for each of the three months from July through September and the total profit for the three months.

b. Calculate the cash balance at the end of each month.

c. Prepare a statement of financial position.at the end of September.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting For Managers Interpreting Accounting Information For Decision Making

ISBN: 9781118037966

1st Canadian Edition

Authors: Paul M. Collier, Sandy M. Kizan, Eckhard Schumann

Question Posted: