Maja and Mina are both divisions of Arbor Group. Both divisions trade on the open market but

Question:

Maja and Mina are both divisions of Arbor Group. Both divisions trade on the open market but Maja also provides almost a quarter of its production output to Mina. Maja believes that Mina pays less than Maja could sell the product for on the open market.

As evidence, Maja has calculated its cost of sales as 40% of external sales and 60% of intercompany sales.

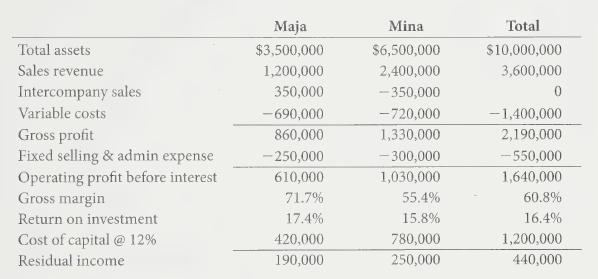

The operating results of the company are shown below. The divisional managers are rewarded on the basis of achieving an ROI, provided that it is greater than the cost of capital of 12%. The higher the ROI over that base, the higher the divisional manager’s performance bonus.

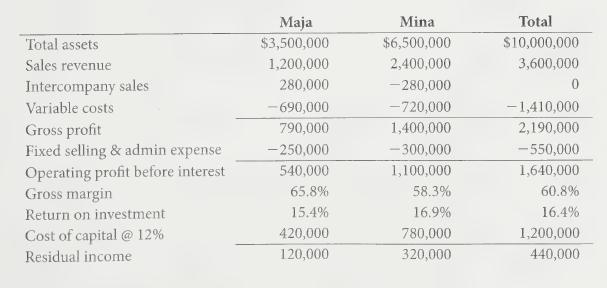

The management team of Mina has argued that it has been unfairly treated due to the transfer price from Maja. It has recalculated its performance (and that of Maja) based on a reduction in the transfer price by 20%. The revised figures produced by Mina’ financial controller are shown below:

a. What are the strengths and weaknesses of Mina’s argument?

b. What position would you take if you were on the management team of Maja?

c. How should Arbor Group resolve this issue?

Step by Step Answer:

Accounting For Managers Interpreting Accounting Information For Decision Making

ISBN: 9781118037966

1st Canadian Edition

Authors: Paul M. Collier, Sandy M. Kizan, Eckhard Schumann