Phonic Solutions is considering creating a new division, which will require an investment in computer and telecommunications

Question:

Phonic Solutions is considering creating a new division, which will require an investment in computer and telecommunications equipment of \($10\) million. The company has a cost of capital of 12%.

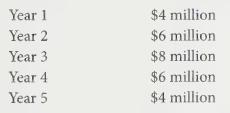

The sales department has forecast sales for each of the next five years for this new division as follows:

Operations staff has predicted the cost of sales as 30% of revenue. Rent and office expenses are \($300,000\) each year. Selling and administration salaries will be \($400,000\) in the first year, increasing each year by 5%. Repairs & maintenance will be \($100,000\) in each of Years 1 and 2, \($200,000\) in each of Years 3 and 4, and \($300,000\) in Year 5. The company depreciates its equipment over four years.

a. Produce the following:

Profit budget for each of the five years, showing both gross profit and operating profit

• Cash flow for each of the five years

• Discounted cash flow analysis and use this to recommend whether the new division and capital investment should proceed

b. What does theory tell us about the strengths and limitations of budgeting and the discounted cash flow technique?

Step by Step Answer:

Accounting For Managers Interpreting Accounting Information For Decision Making

ISBN: 9781118037966

1st Canadian Edition

Authors: Paul M. Collier, Sandy M. Kizan, Eckhard Schumann