(Target Costing) Driftwood Industries currently sells coffee tables for ($450) each. It has costs per table of...

Question:

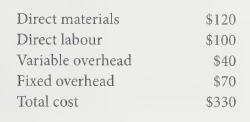

(Target Costing) Driftwood Industries currently sells coffee tables for \($450\) each. It has costs per table of \($330.\) A new competitor is opening in the same mall as Driftwood and offers a similar coffee table for \($390.\) The company believes it must lower its price in order to not lose customers to this new company. Bob Jonas, the owner of Driftwood Industries, feels that he may be able to increase his sales of coffee tables by 20% if he lowers his price to \($380.\) He currently sells 1,000 coffee tables per year. Bob was able to compile the following information about the costs of the coffee tables:

Fixed overhead is based on production of 1000 tables per year.

Bob feels he can reduce direct labour costs by 15% if he purchases a new saw for \($6,000\) that will be depreciated over 3 years.

a. What is the target cost if the target operating income is 25% of sales?

b. Is this cost achievable? Show your calculations.

c. By how much would Bob need to increase production to make the purchase of the new saw worthwhile?

Step by Step Answer:

Accounting For Managers Interpreting Accounting Information For Decision Making

ISBN: 9781118037966

1st Canadian Edition

Authors: Paul M. Collier, Sandy M. Kizan, Eckhard Schumann