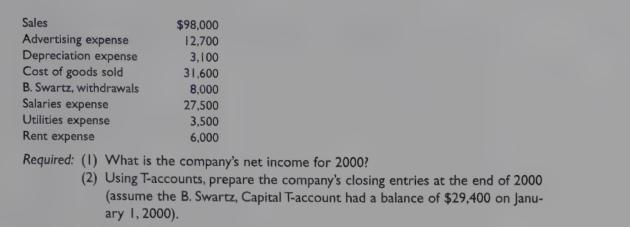

The revenue, expense, and withdrawals T-account balances of the Swartz Furniture Company on December 31, 2000 are

Question:

The revenue, expense, and withdrawals T-account balances of the Swartz Furniture Company on December 31, 2000 are as follows: lop85

Transcribed Image Text:

Sales $98,000 Advertising expense 12,700 Depreciation expense 3,100 Cost of goods sold 31,600 B. Swartz, withdrawals 8.000 Salaries expense 27,500 3,500 6,000 Utilities expense Rent expense Required: (1) What is the company's net income for 2000? (2) Using T-accounts, prepare the company's closing entries at the end of 2000 (assume the B. Swartz, Capital T-account had a balance of $29,400 on Janu- ary 1, 2000).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

Answered By

Muhammad Ahtsham Shabbir

I am a professional freelance writer with more than 7 years’ experience in academic writing. I have a Bachelor`s Degree in Commerce and Master's Degree in Computer Science. I can provide my services in various subjects.

I have professional excellent skills in Microsoft ® Office packages such as Microsoft ® Word, Microsoft ® Excel, and Microsoft ® PowerPoint. Moreover, I have excellent research skills and outstanding analytical and critical thinking skills; a combination that I apply in every paper I handle.

I am conversant with the various citation styles, among them; APA, MLA, Chicago, Havard, and AMA. I also strive to deliver the best to my clients and in a timely manner.My work is always 100% original. I honestly understand the concern of plagiarism and its consequences. As such, I ensure that I check the assignment for any plagiarism before submission.

4.80+

392+ Reviews

587+ Question Solved

Related Book For

Accounting Information For Business Decisions

ISBN: 9780030224294

1st Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley

Question Posted:

Students also viewed these Business questions

-

Hello again I need help with some more accounting questions. Could you please help? Please see attachment! Question 1 The Red Roses Law Firm prepays for advertising in the local newspaper. On January...

-

Total assets for our company are $500,000, and total liabilities are $250,000. The company paid $50,000 in dividends during the year. What does the total owner's equity equal? Group of answer choices...

-

I really need help with my assignments. Can somebody help me answer the problems with solution? Please. I will highly appreciate it. Thank you in advance. 1. Crispin Santos started a retail...

-

Bonita Company's income statement contained the following condensed information. BONITA COMPANY Income Statement For the Year Ended December 31, 2022 Service revenue Operating expenses, excluding...

-

The less time that a manager devotes to staffing a team and preparing its members to complete the project to which they are assigned, the more time gets used up in the forming and storming phases of...

-

On April 2, 2013, Montana Mining Co. pays $ 3,721,000 for an ore deposit containing 1,525,000 tons. The company installs machinery in the mine costing $ 213,500, with an estimated seven- year life...

-

P19-1A Suppose Dell Computer reported the following costs last month. (All costs are in millions.) Payment to UPS for delivering PCs to customers.. Cost of hard drives used..... $ 250 3,300 Cost of...

-

Deluca Solutions Inc. is an Ontario- based manufacturer. The company is listed on the TSX, but the family of founder David Deluca retains control through multiple- voting shares. Deluca undertook...

-

11 Required information [The following information applies to the questions displayed below.] Part 4 of 4 Dain's Diamond Bit Drilling purchased the following assets this year. 0.5 points Asset Drill...

-

Refer to 6-29. Combine the two depreciation expense amounts, and combine the two salaries expense amounts. Assume that D. Foile withdrew $7,200 from the company during the current year and that the...

-

The beginning balance in the R. Barnum, Capital account on October | of the current year, was $20,000. For October, the Barnum Company reported total revenues of $3,000 and total expenses of $1,250....

-

GfK Roper Consulting gathers information on consumer preferences around the world to help companies monitor attitudes about health, food, and healthcare products. They asked people in many different...

-

Maria A Solo (SSN 318-01-6921) lives at 190 Glenn drive, grand rapids, Michigan 49527-2005. Maria (age 45 and single) claims her aunt, Selda Ray (ssn 282-61-4011), as a dependent. Selda lives with...

-

A clinical trial was conducted to test the effectiveness of a drug used for treating insomnia in older subjects. After treatment with the drug, 11 subjects had a mean wake time of 95.1 min and a...

-

PROBLEM 13-3 Translation-Local Currency Is the Functional Currency LO7 (This problem is a continuation of the illustration presented in the chapter.) On January 2, 2019, P Company, a US-based...

-

The operations manager for a local bus company wants to decide whether he should purchase a small, medium, or large new bus for his company. He estimates that the annual profits (in $000) will vary...

-

Claim: Fewer than 8.2% of homes have only a landline telephone and no wireless phone. Sample data: A survey by the National Center for Health Statistics showed that among 13,215 homes 5.78% had...

-

Refer to the information in Practice 5-6. Compute cash paid for operating expenses.

-

As of January 1, 2018, Room Designs, Inc. had a balance of $9,900 in Cash, $3,500 in Common Stock, and $6,400 in Retained Earnings. These were the only accounts with balances in the ledger on January...

-

Los siguientes datos corresponden a las operaciones de Turk Company el ao pasado: Ventas $ 900 000 Utilidad operativa neta $ 36 000 Margen de contribucin $ 150 000 Activos operativos promedio $ 180...

-

Problem 16-16 Tax Shields (LO2) River Cruises is all-equity-financed with 53,000 shares. It now proposes to issue $280,000 of debt at an interest rate of 12% and to use the proceeds to repurchase...

-

In a process costing system, companies use predetermined overhead rates to apply overhead

Study smarter with the SolutionInn App